Photo by Richard Hurd

Metro Metrics July 2025

Metro Metrics is a monthly data snapshot that explores key economic indicators reflecting the health of the Madison metro economy.

The Engine that Can

The Greater Madison region is one of the economic engines driving innovation in Wisconsin and the nation. With the most industry-diverse economy in the nation, no single sector dominates the employment landscape. But to understand factors fueling economic growth, we look to the region’s advanced industries.

Brookings Institution defines advanced industries as those with a large share of STEM (Science, Technology, Engineering and Math) workers and high Research and Development (R&D) investment. These industries range from advanced manufacturing to medical devices to fast-growing tech services. Research has shown that for every advanced industry job created, an additional 2.2 jobs are created, 0.8 locally and 1.4 nationally, supporting nearly a quarter of all domestic employment.

Greater Madison’s leading advanced industries are software publishing (13,748 employed, with a location quotient of 8.27), scientific R&D (6,126 employed, 2.54 LQ), architectural, engineering and related services (5,732 employed, 1.28 LQ) and medical and diagnostic laboratories (3,714 employed, 4.56 LQ).

From the Bottom to the Top

We can dig further into the region’s high-tech sector by looking at the Census Bureau’s Business Dynamics Statistics (BDS). While narrower in scope, all of the sectors included in the BDS high-tech dataset are also advanced industries, offering a useful picture of employment and business trends.

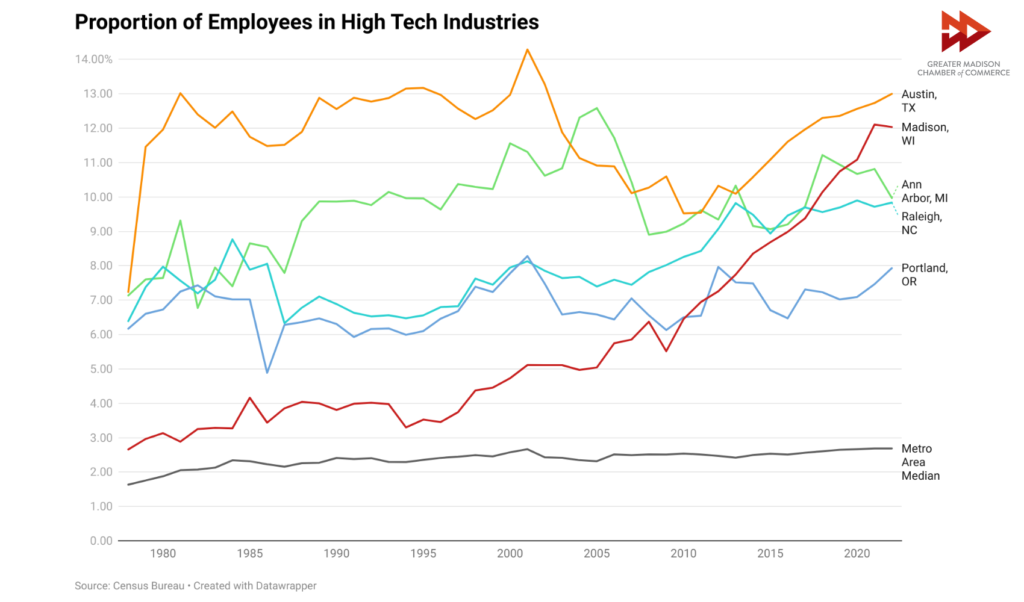

In 1978, the Madison metro ranked 147th among all U.S. metros in the proportion of employees working in high-tech industries, trailing peer regions like Ann Arbor, Austin, Portland and Raleigh. In 2022, the latest year available, Madison now ranks 11th in the country — a significant swing.

Fig. 1 shows the concentration of high-tech jobs in the Greater Madison region and peer regions over time, as well as the median value among U.S. metros. The median proportion has remained steady at 2-3% of total employment among metropolitan areas since 1980. Some of our peer regions, such as Portland and Raleigh, also reflect this lack of growth in employment concentration, with Portland consistently seeing roughly 6-8% of its workforce employed in high-tech industries and Raleigh remaining in the 7-10% range. Greater Madison, by contrast, accelerated from less than 6% of the workforce in 2010 to more than double that value in 2022.

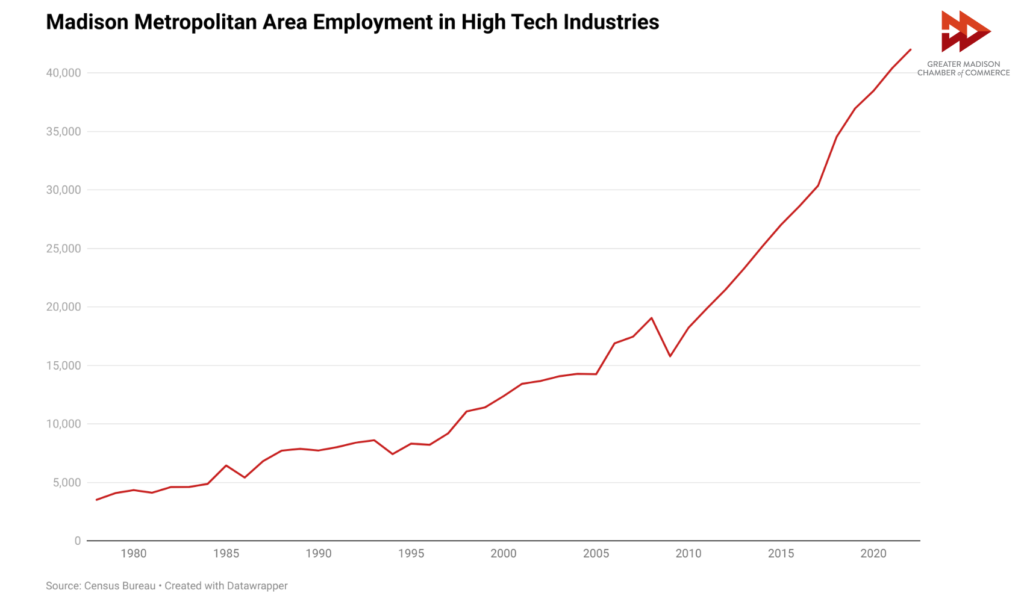

Since 2010, Greater Madison has experienced some of the fastest growth in high-tech employment concentration in the country, increasing from 18,233 jobs in 2010 to 42,010 in 2022 (Fig. 2). While software publishing accounts for 30% of that total — and explains why our region now has the highest concentration of these jobs in the country — most of the growth comes from other advanced industry sectors.

Additionally, over that same period, non-high-tech jobs increased by 42,629. This highlights that over the last 12 years, high-tech jobs accounted for more than one in three new jobs created in the Madison metro.

Local Gains

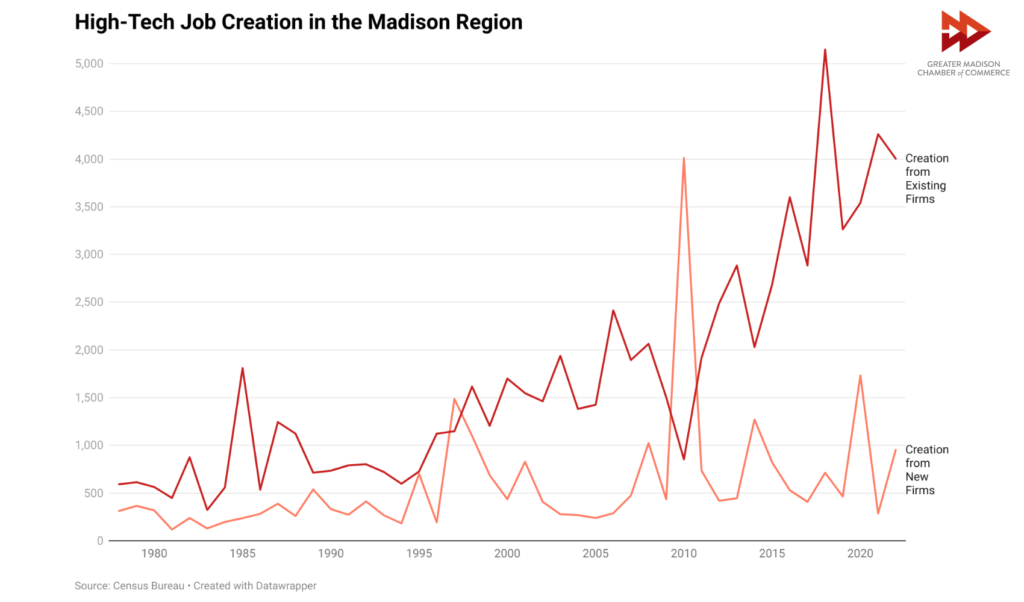

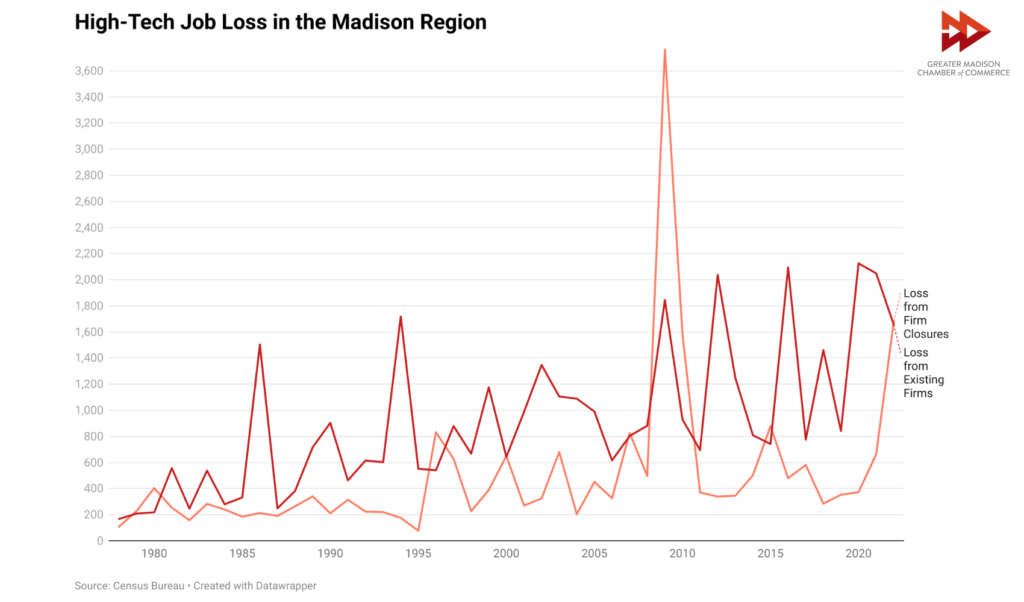

The BDS data also assesses whether job gains or losses came from existing businesses. When viewing job gains by firm age, a clear pattern emerges to explain Greater Madison’s high-tech surge. Existing high-tech firms have been hiring more people almost every year since 2010. Job losses, meanwhile, have remained relatively consistent, with only occasional spikes

Figs. 3 and 4 demonstrate the hiring power that existing firms bring to the Greater Madison region and how much that power has grown since 2010.

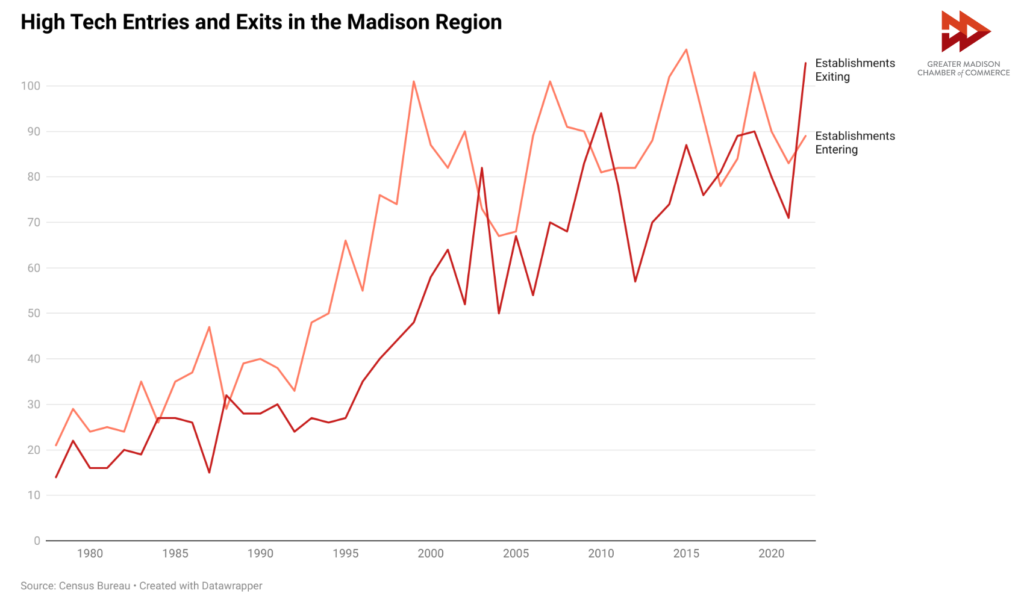

New and emerging high-tech startups have also had a positive impact with a net gain of 111 high-tech establishments since 2010 — a little less than 10 new businesses per year (Fig. 5).

Fig. 1

Fig. 2

Fig. 3

Fig. 4

Fig. 5

Sources:

Census Bureau, Business Dynamics Statistics of U.S. High-Tech Industries (BDS-HT)

Bureau of Labor Statistics, Quarterly Census of Employment and Wages