Photo by Richard Hurd

Metro Metrics September 2025

Metro Metrics is a monthly data snapshot that explores key economic indicators reflecting the health of the Madison metro economy.

Madison’s Startup Economy

As the Chamber’s 12th annual Pressure Chamber startup initiative concludes in San Francisco next month, this edition of Metro Metrics explores data on the health of the region’s entrepreneurial ecosystem.

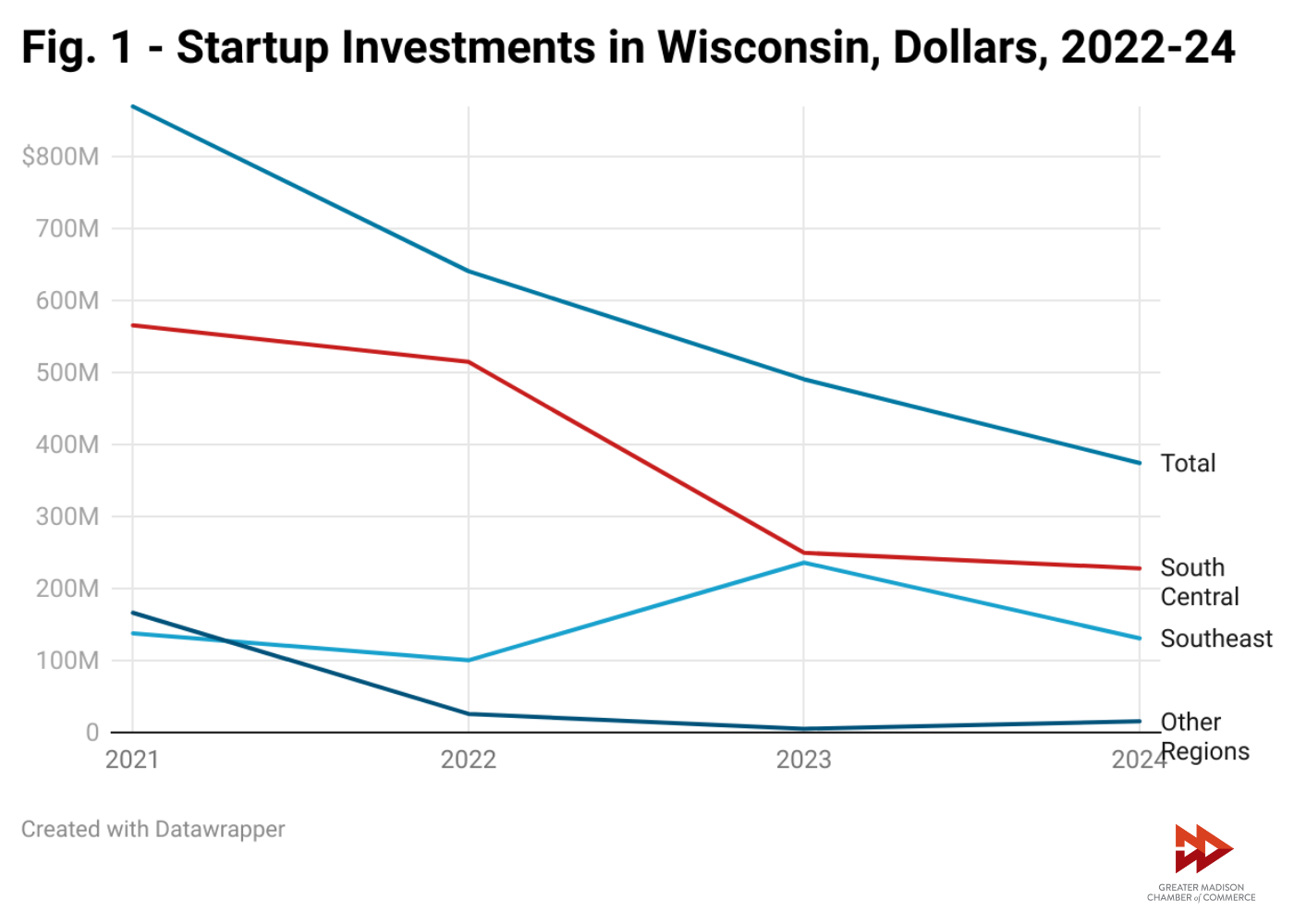

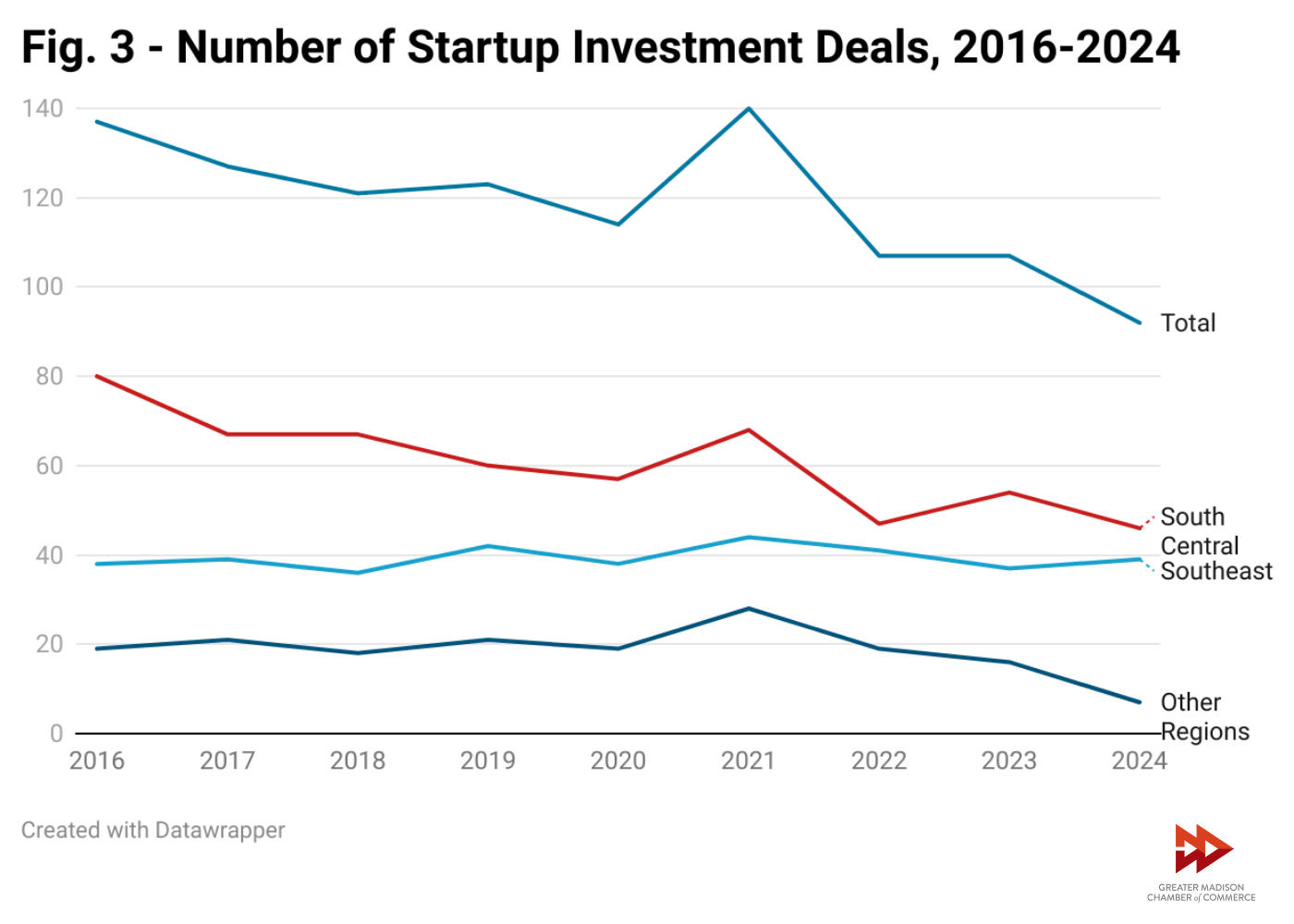

Wisconsin Technology Council data shows that total angel and venture capital investment in Wisconsin has declined in recent years, from more than $640 million in 2022 to less than $375 million in 2024. This broadly tracks with national trends, where venture investment peaked in 2021 and 2022, followed by declines. Nationally, from 2022 to 2023, total venture capital investment declined by more than 60% according to the National Venture Capital Association’s 2024 Yearbook.

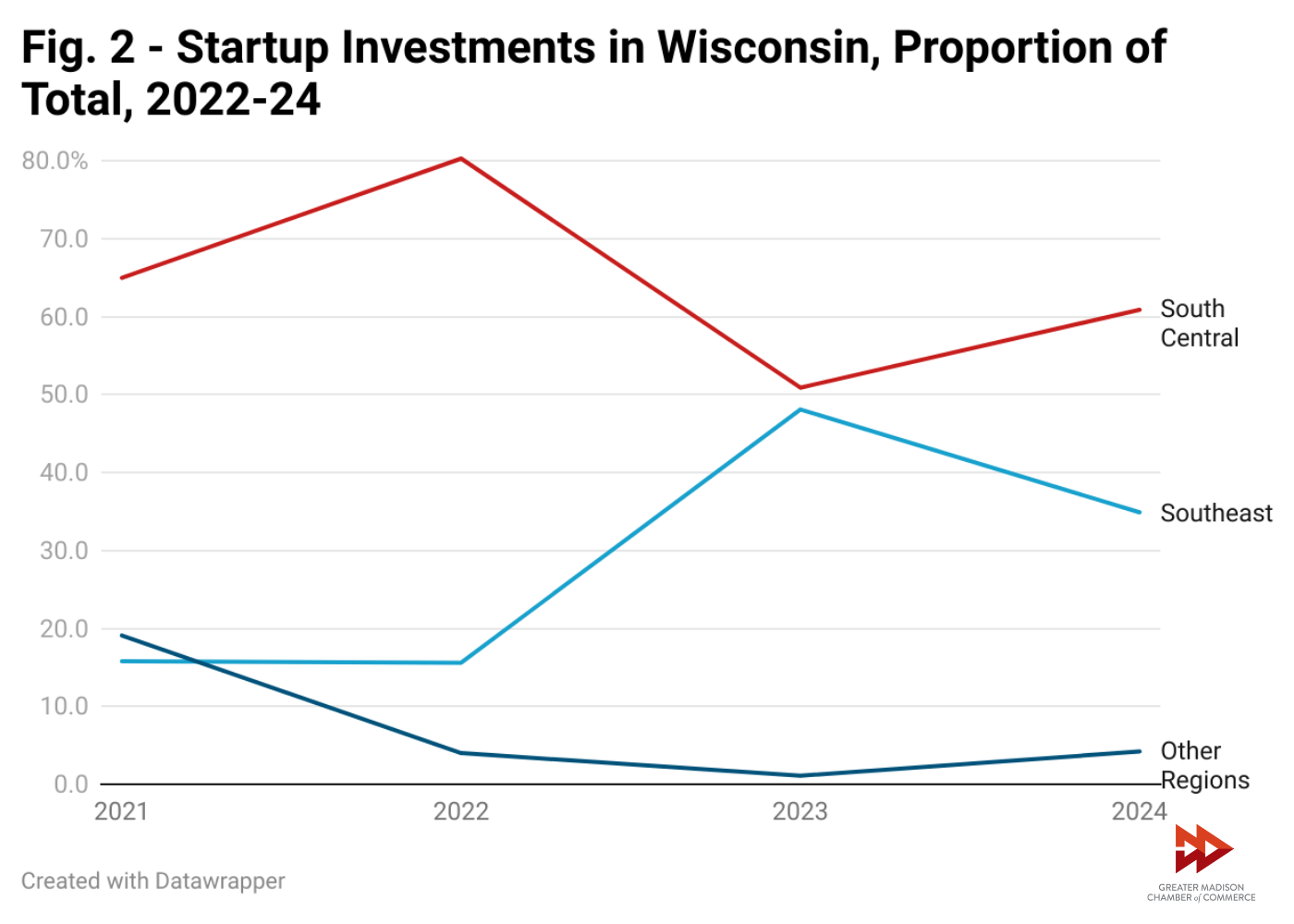

The regions of Greater Madison and Milwaukee Metro are the engines that drive Wisconsin’s entrepreneurial economy. Collectively, the two regions accounted for more than 95% of the total dollars invested in the state and more than 80% of deal flow since 2022.

Greater Madison has consistently generated a majority of the state’s investment totals. In 2024, the Wisconsin Technology Council reported the region secured $228 million from 46 deals, equaling more than 60% of the dollars raised in Wisconsin. While sizable, Greater Madison’s investment totals in 2024 declined more than 50% from two years prior.

An additional comprehensive dataset comes from the Midwest Startups Annual City Rankings, where Madison continues to be ranked among the top 10 Midwest cities for startups from 2017-2025. Some of the positive indicators include the region having both the third highest startup density (number of startups per capita) and population with at least a bachelor’s degree, as well as fifth in number of accelerators and incubators to support startup growth.

The report also highlighted some challenges compared to other peer cities in the Midwest, including startup growth since the pandemic and exit activity, an important metric that demonstrates startups can scale and yield a significant return for investors.

Similar data on new company growth was also covered in a recent Metro Metrics, showing that Greater Madison has a mid-to-low rate of establishment entries compared to peer regions such as Ann Arbor, Austin, Portland and Raleigh. An establishment entry rate of 10.33 for the high tech sector and 9.34 for non-high tech businesses means that, each year, about 10% of Greater Madison’s exiting establishments are joined by new ones. This is slightly below the national medians of 11.96 for high-tech and 10.09 for non-high tech businesses. The number of business establishments per capita in the Greater Madison region has remained roughly consistent over the past decade, with about one establishment for every 40-43 people in the metropolitan area since 2013.