Category: Economy News

Photo by Richard Hurd

Metro Metrics January 2026

Metro Metrics is a monthly data snapshot that explores key economic indicators reflecting the health of the Madison metro economy.

Tracking Regional Workforce Housing

Available housing supply has been a challenge in the Madison region for years. A 2019 report by the Wisconsin REALTORS® Association found that Dane County underproduced more than 11,000 housing units from 2006 to 2017. And the Dane County Regional Housing Strategy concluded that the county needs to produce at least 7,000 new housing units per year for supply to keep up with demand.

This month’s edition of Metro Metrics takes a look at recent data to assess our collective progress on this issue.

Madison’s Apartment Market

One source the Chamber uses for housing data is CoStar. This database of commercial properties helps us analyze trends in apartment rental markets across the country.

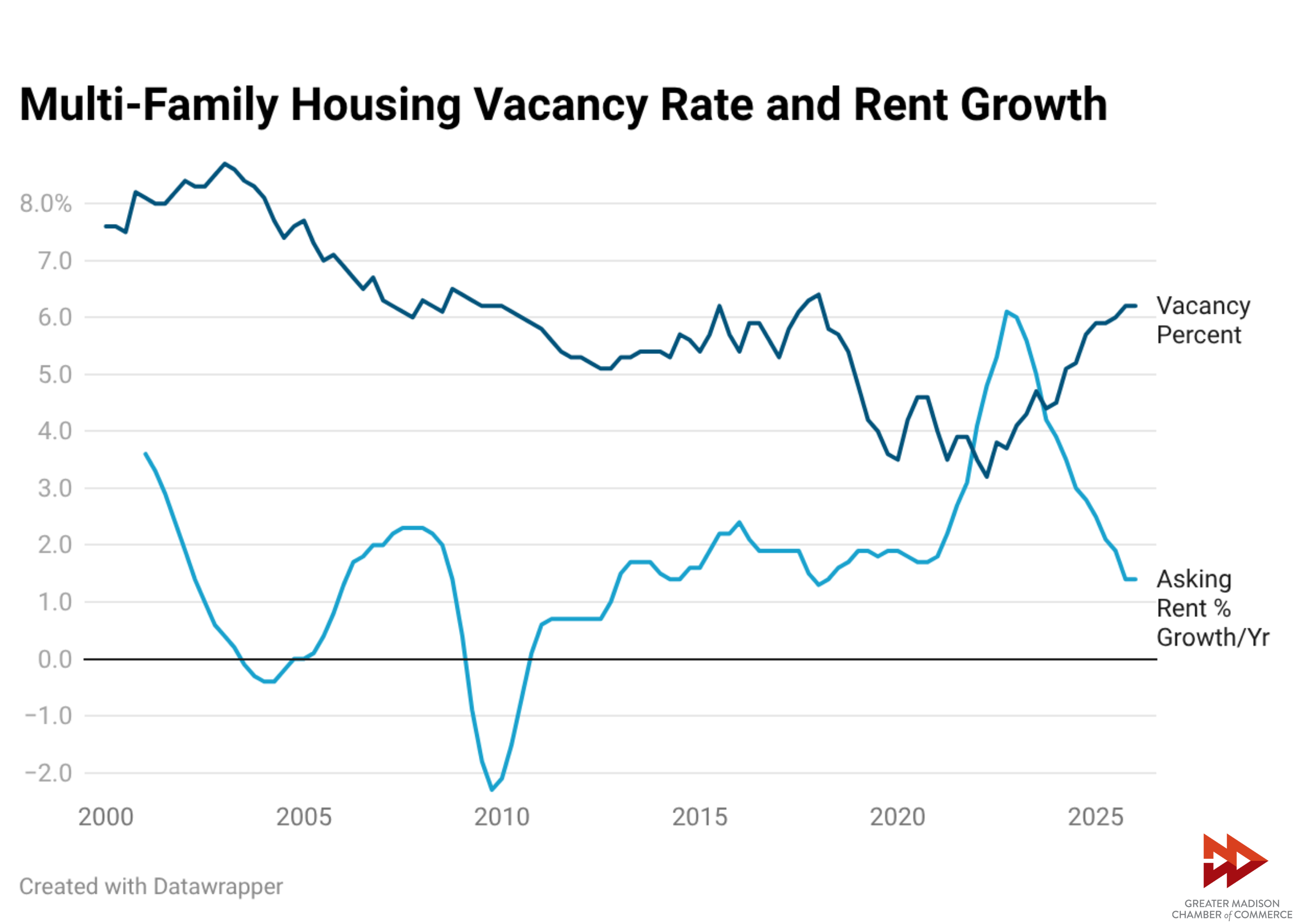

In 2025, the Madison Metro added a net 2,802 multi-family housing units, an increase of 2.8%. Effects of this added supply include a modest increase to the region’s vacancy rate from 5.9% to 6.2% and a reduction to the region’s year-over-year asking rent price growth from 2.5% to 1.4% (Fig. 1).

A clear correlation can be seen between vacancy rate and rent growth. When vacancy rates dip below 4%, as they did in 2020 and 2021, rent increases typically follow. Now that vacancy rates in the region have begun increasing again, rent growth has dropped down to its typical 1-2%-per-year rate.

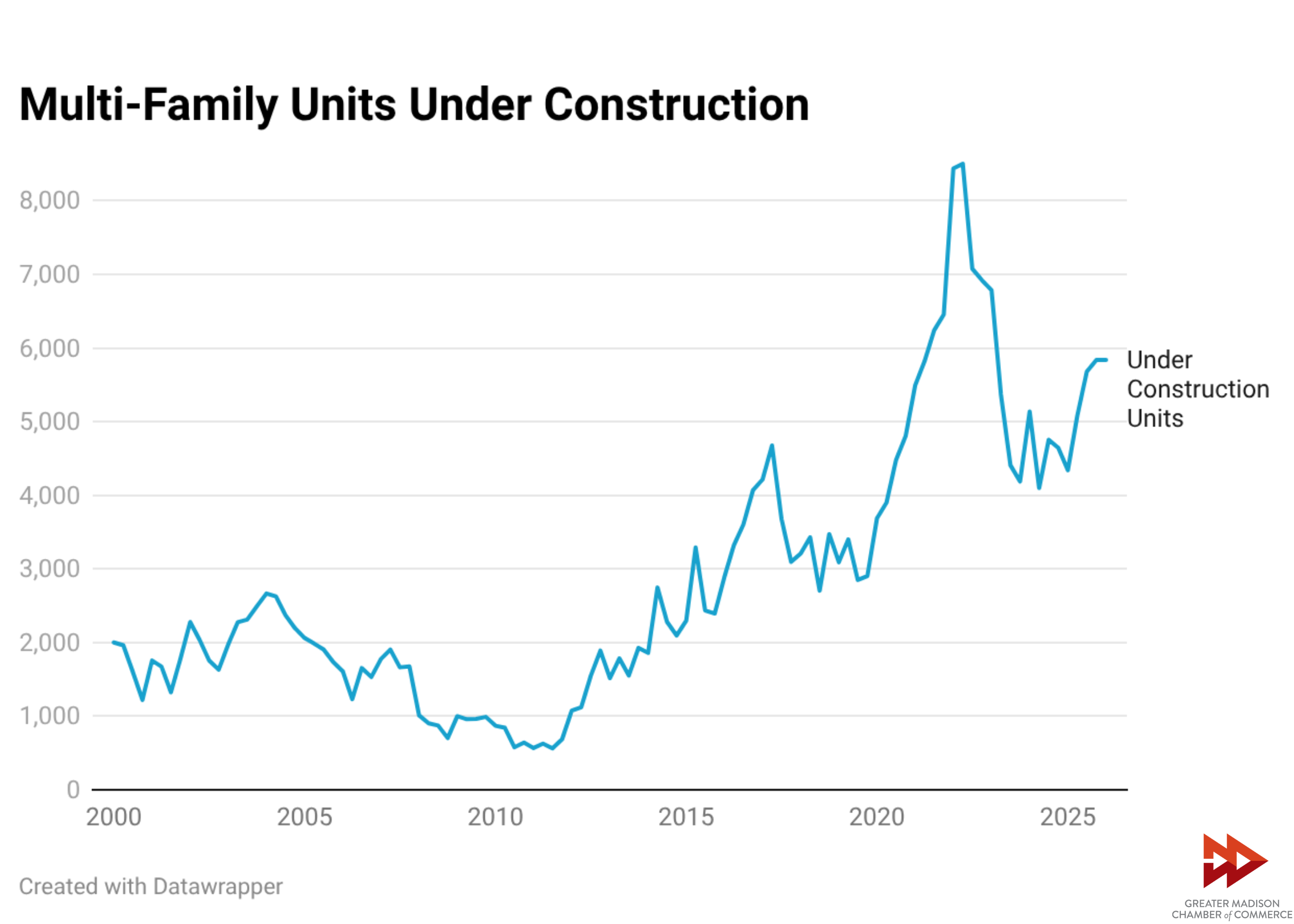

CoStar reports there are 5,837 multifamily housing units currently under construction in the region (Fig. 2). This figure is higher than at any point before the pandemic but remains below the peaks recorded in 2021 and 2022. Overall, there is a strong upward trend in number of units under construction.

Single-Family Home Sales

The Wisconsin REALTORS® Association recently released their December 2025 report, which included data on single-family home sales in all Wisconsin counties. According to the report, the Madison Metro market grew over the past year. Columbia, Dane and Green counties saw increases in sales. Iowa County was the only county in the metro to experience a decline.

Benchmarking Progress

The City of Madison has a housing tracker on its website with valuable information about the quantity and type of housing that is being built within the city. Madison leaders set a goal to build 15,000 new housing units by 2030, an average of 3,000 units per year. Last year the city added a net 2,328 housing units, slightly less than the target number. Currently, 5,320 units are under construction.

An additional data point is the Dane County Regional Housing Strategy 2024 Annual Metrics Report. This report is based on a survey of Dane County municipalities regarding their activities in the 2024 calendar year. The report found that seven of 12 municipalities had affordable housing funds, which the strategy defined as a key need in the region’s housing market. The report also found that 700 affordable housing units were funded in Dane County in 2024 (out of the 1,765 the report set as an annual target) and that 172 affordable senior housing units were funded (out of the 700 the report set as an annual target).

The strategy includes a target number of 7,000 total housing units per year in Dane County. In 2024, 5,477 housing units were permitted county-wide. Though an increase from 2023, the number of housing units permitted still misses the strategy’s goal. The report “illustrates both early momentum and the scale of work still required,” a statement which applies not just to Dane County’s housing market but also the entire region.

Photo by Richard Hurd

Metro Metrics December 2025

Metro Metrics is a monthly data snapshot that explores key economic indicators reflecting the health of the Madison metro economy.

Q3 Economic Update

This month’s edition of Metro Metrics examines key indicators of Greater Madison’s economy and how they fared during Q3 of 2025.

Industries

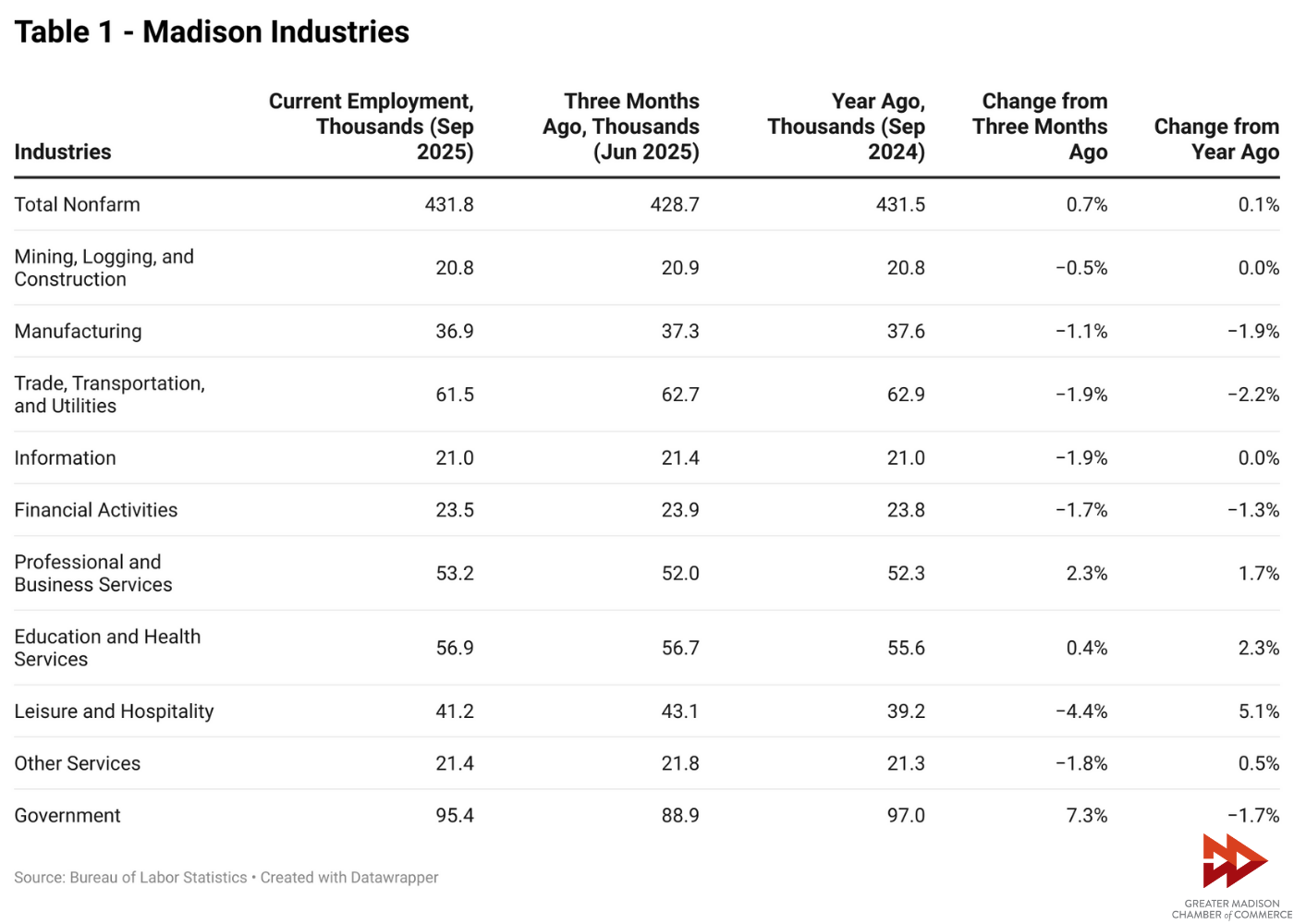

The Metro’s job numbers began rebounding after decreasing slightly earlier this year (Table 1). Total nonfarm jobs in September exceeded last year’s total jobs for the first time since April. The industries that have grown the most are leisure and hospitality (up 5.1%) and education and health services (up 2.3%). Employment in trade, transportation and utilities decreased by 2.2% since last year.

Labor Force

Greater Madison continues to have a lower unemployment rate than the state of Wisconsin and the nation (Table 2). The Metro’s unemployment rate of 2.3% is fifth lowest out of 387, after only Sioux Falls, SD (1.8%), Rapid City, SD (1.9%), Bismarck, ND (2.0%) and Honolulu, HI (2.2%). The region’s labor force, employed people and unemployed people all decreased since last year. Total labor force decreased by 2.7%, employed people decreased by 2.8% and unemployed people decreased by 6.2%. These figures reinforce findings in the 2025 Next Normal (N²) survey, showing talent attraction and retention as the top barrier to business growth. It also reinforces the importance of talent development and effectively aligning education, training and industry needs to expand the available workforce.

Housing Building Permits

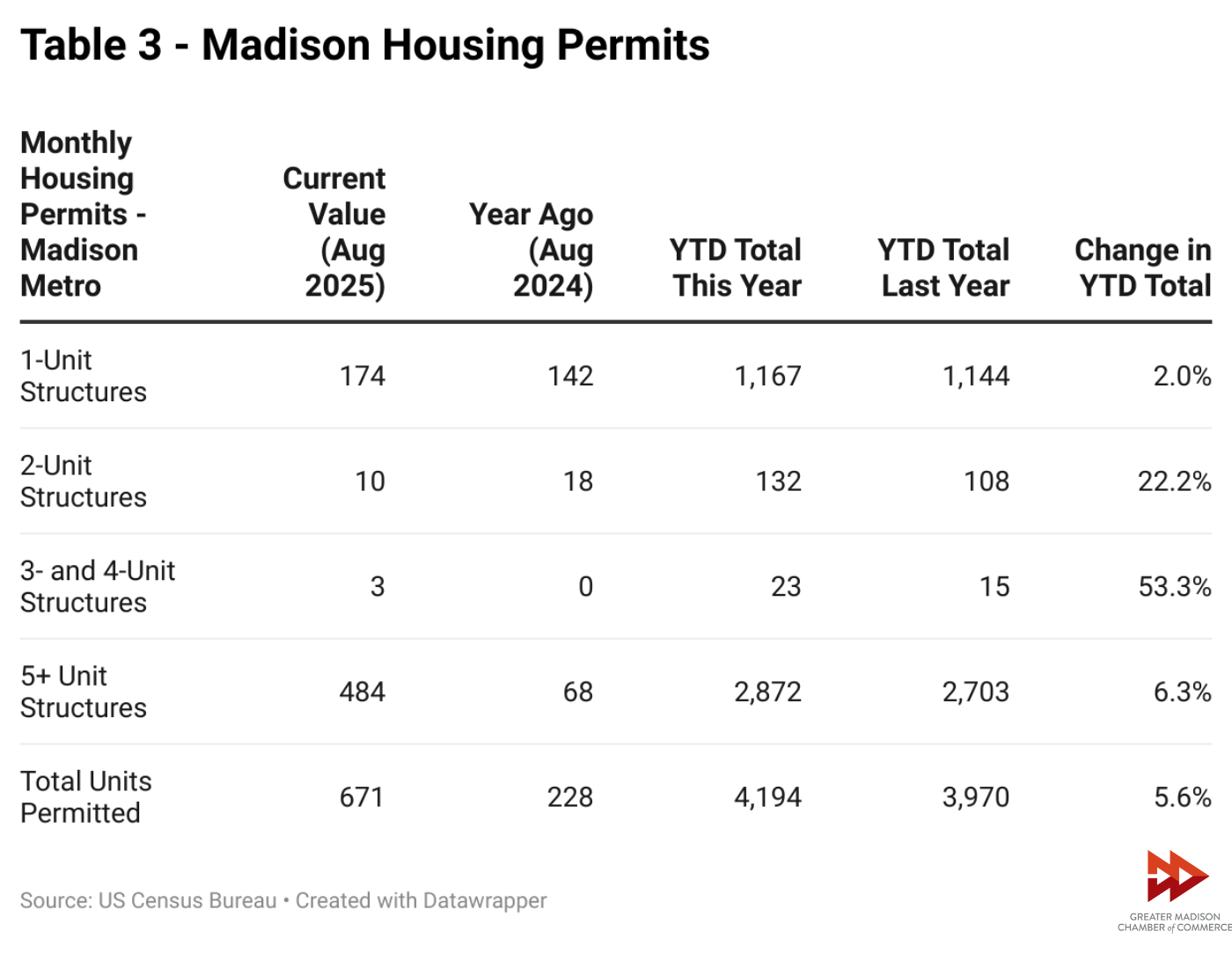

Due to the government shutdown earlier this year, Census Building Permits data for September has not been released, so this section will only cover building permits up to August (Table 3). The Metro has permitted more housing units this year YTD than last year, with nearly 4,200 housing units approved – an increase of about 5.6%.

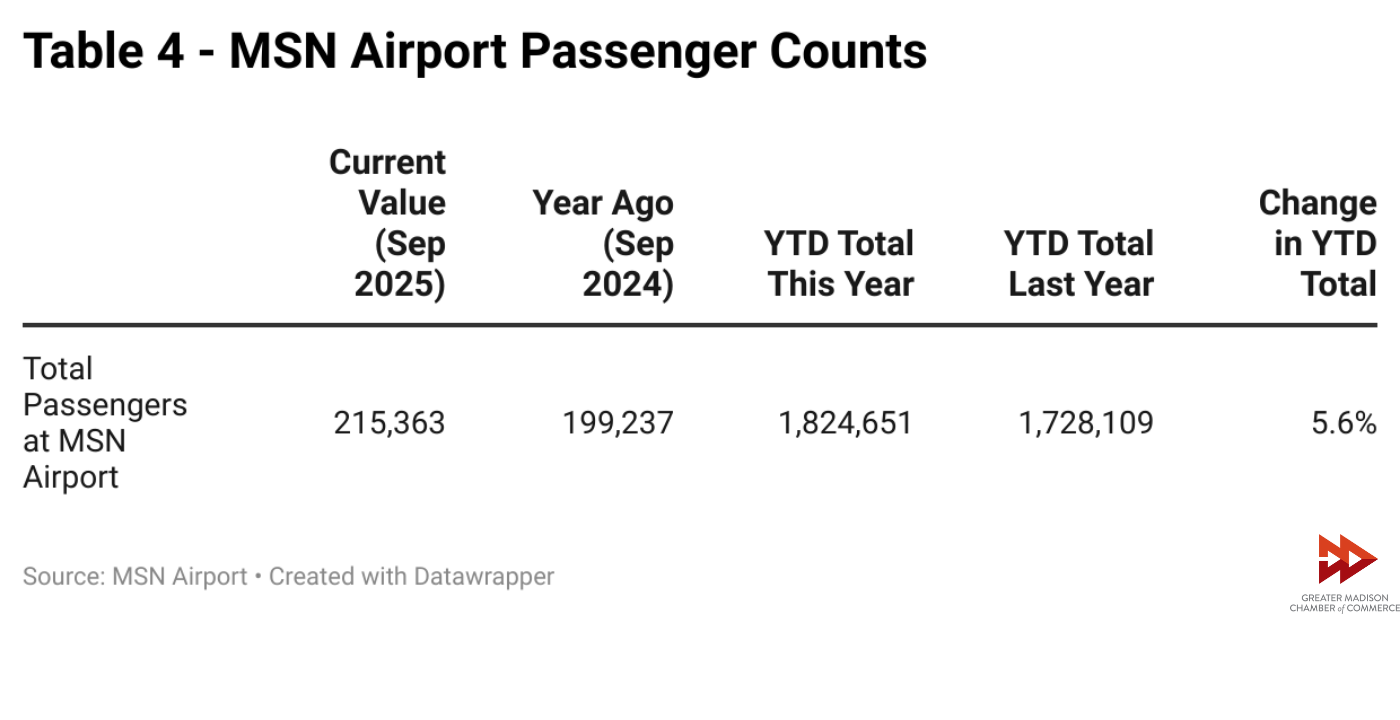

MSN Airport Update

This year’s Dane County Regional Airport passenger counts YTD surpassed pre-pandemic records and are on track to be the airport’s best year yet (Table 4). For more information on how the airport is doing and what its future plans are, the Chamber recently hosted an edition of our Lunch(UP)date program with the airport’s new Executive Director, Mark Papko.

In addition to traffic counts, the airport also recently announced new nonstop service to Boston – one of the most requested business destinations.

Photo by Richard Hurd

Greater Madison Chamber of Commerce to Integrate MadREP’s Work, Creating a Unified Force for Regional Economic Development

FOR IMMEDIATE RELEASE (Dec. 12, 2025)

Contact: Communications Manager Jess Miller, jess@madisonbiz.com, (608) 443-1952

Greater Madison Chamber of Commerce to Integrate MadREP’s Work, Creating a Unified Force for Regional Economic Development

Move reflects organizations’ shared commitment to region’s future

MADISON, WI — Today, the Madison Region Economic Partnership (MadREP) and the Greater Madison Chamber of Commerce (GMCC) announced a new chapter in regional economic development. Following a year of collaborative discussions and joint planning, MadREP will now transfer its regional economic development responsibilities, creating a more unified structure to accelerate growth and opportunity across south-central Wisconsin.

“This transition reflects our shared belief that the region is stronger when we work together,” said MadREP Board Chair Jason Vangalis. “MadREP’s foundation of collaboration and partnership has positioned the region for success, and this move ensures that work continues with even greater capacity.”

GMCC Board Chair Dan Bertler added: “Regional collaboration has always been essential to achieving greater outcomes. A unified structure will deliver a more effective model and enable coordinated action on our region’s shared priorities.”

GMCC will immediately assume regional economic development responsibilities and, beginning in early 2026, will collaborate in partnership with public- and private-sector leaders on a focused regional strategy that builds upon MadREP’s foundational work.

“This is a natural evolution built on years of partnership,” said GMCC President Zach Brandon. “Integrating MadREP’s work with the region’s largest business association will create a customer-centric approach to increase opportunities and ensure our current growth translates into lasting regional benefits.”

###

Photo by Richard Hurd

Metro Metrics November 2025

Metro Metrics is a monthly data snapshot that explores key economic indicators reflecting the health of the Madison metro economy.

The Next Normal for Greater Madison

Since 2024, the Chamber, in coordination with several partner organizations, has conducted an annual survey of regional employers to assess current and projected economic conditions. These surveys are designed to help us understand the Next Normal (N²) for work and workplaces in our region.

This year’s survey received responses from 241 unique businesses representing 20 different industries. Topline results and partner perspectives were shared at a recent Chamber Lunch(UP)date, which can be viewed here. For this month’s Metro Metrics, we take a closer look at the data to assess trends and peer metro comparisons.

Business Indicators

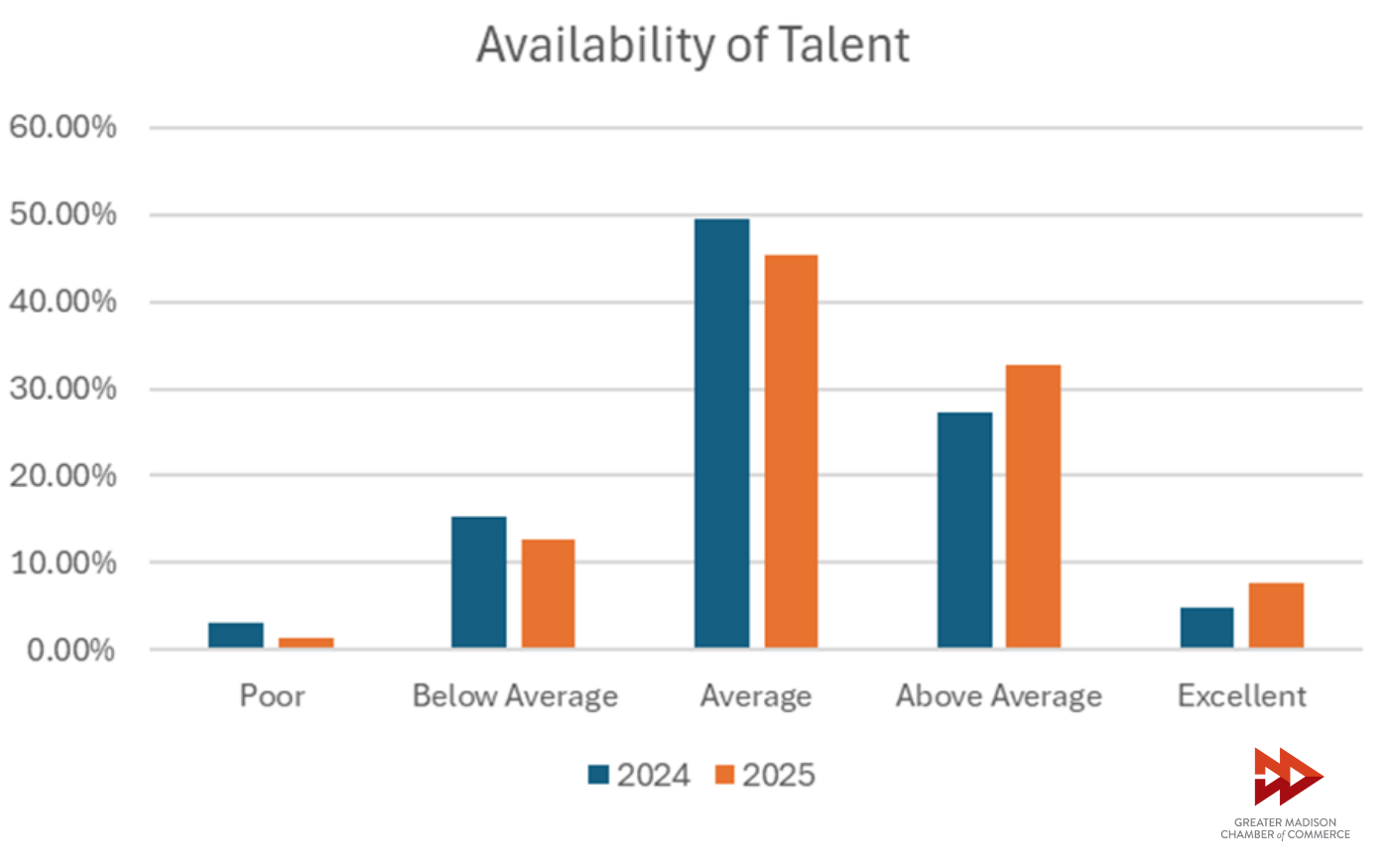

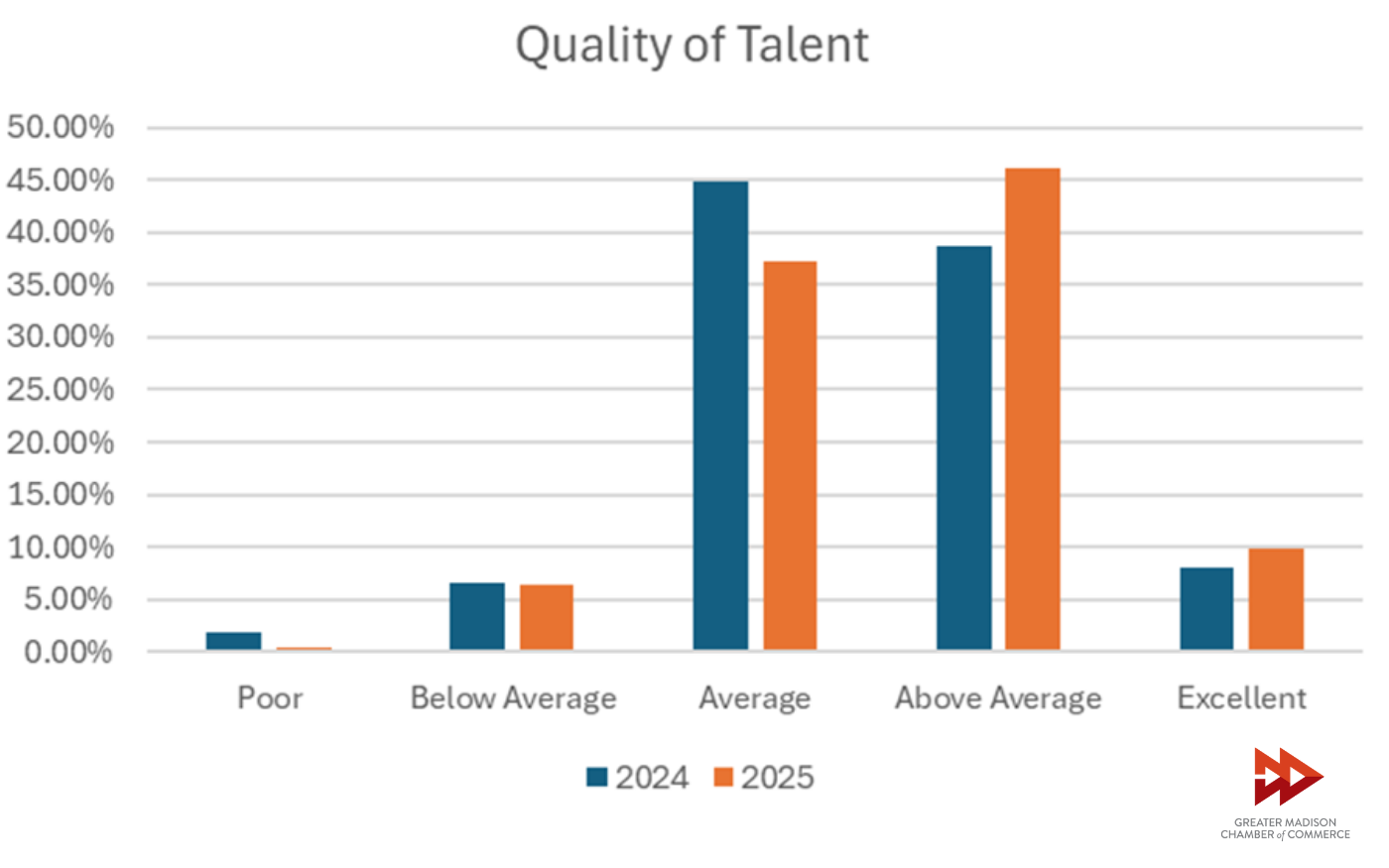

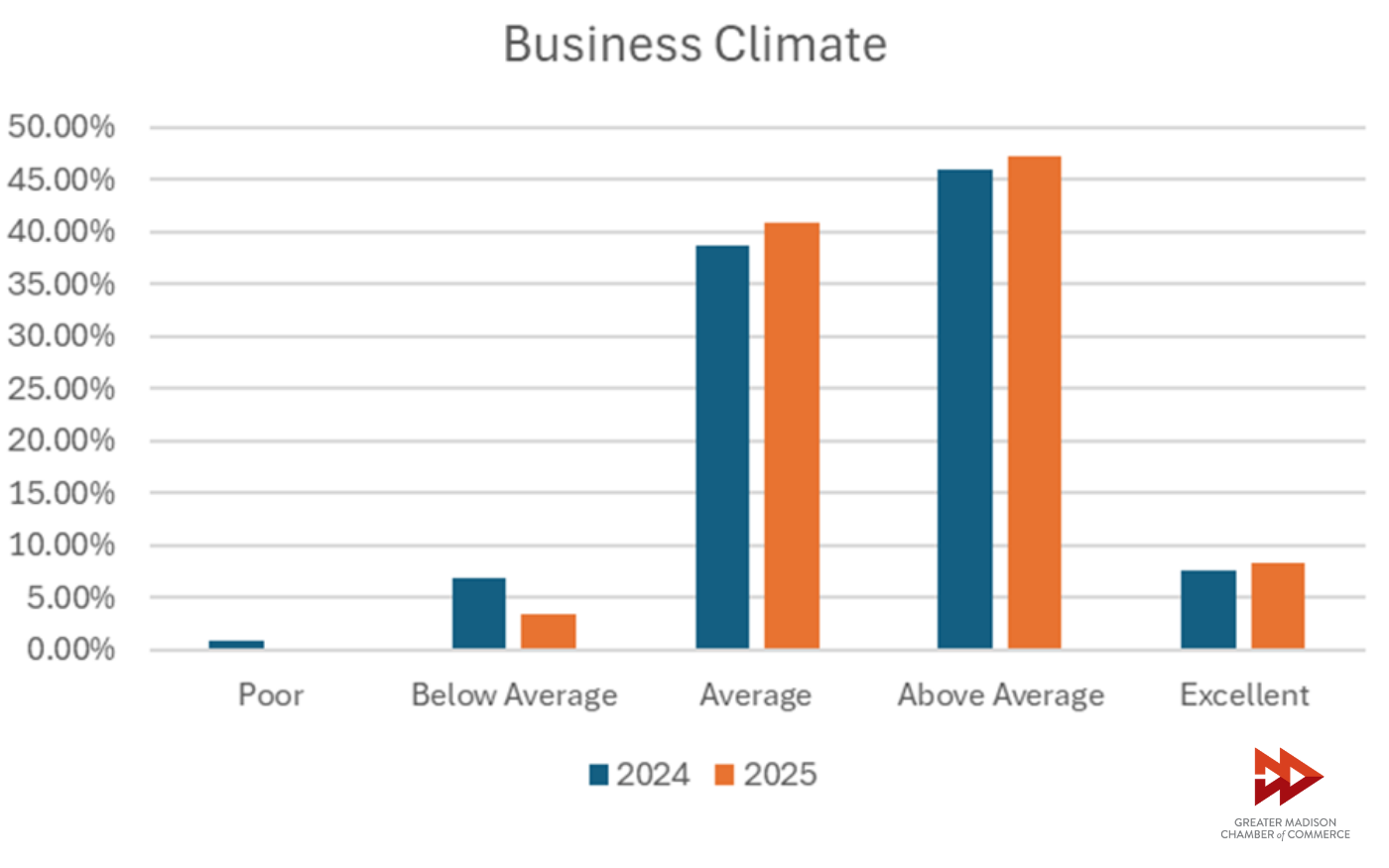

There were many encouraging results for both the availability (Fig. 1) and quality of talent (Fig. 2), with both metrics showing increases in the proportion of businesses that reported them as “average” or better compared to last year’s survey. Similar increases were found in respondent views on the region’s business climate (Fig. 3).

The distribution of responses to these business indicators is shown below. A consistent pattern can be observed in all three measurements. The proportion of businesses that rated these indicators “poor” or “below average” always drops from 2024 to 2025 and the proportion that rated them “above average” or “excellent” always rises. The proportion that rated the indicators “average” either increased or decreased, depending on the indicator. This shows that the improvement isn’t just due to ratings trending towards the middle but that businesses are rating them higher.

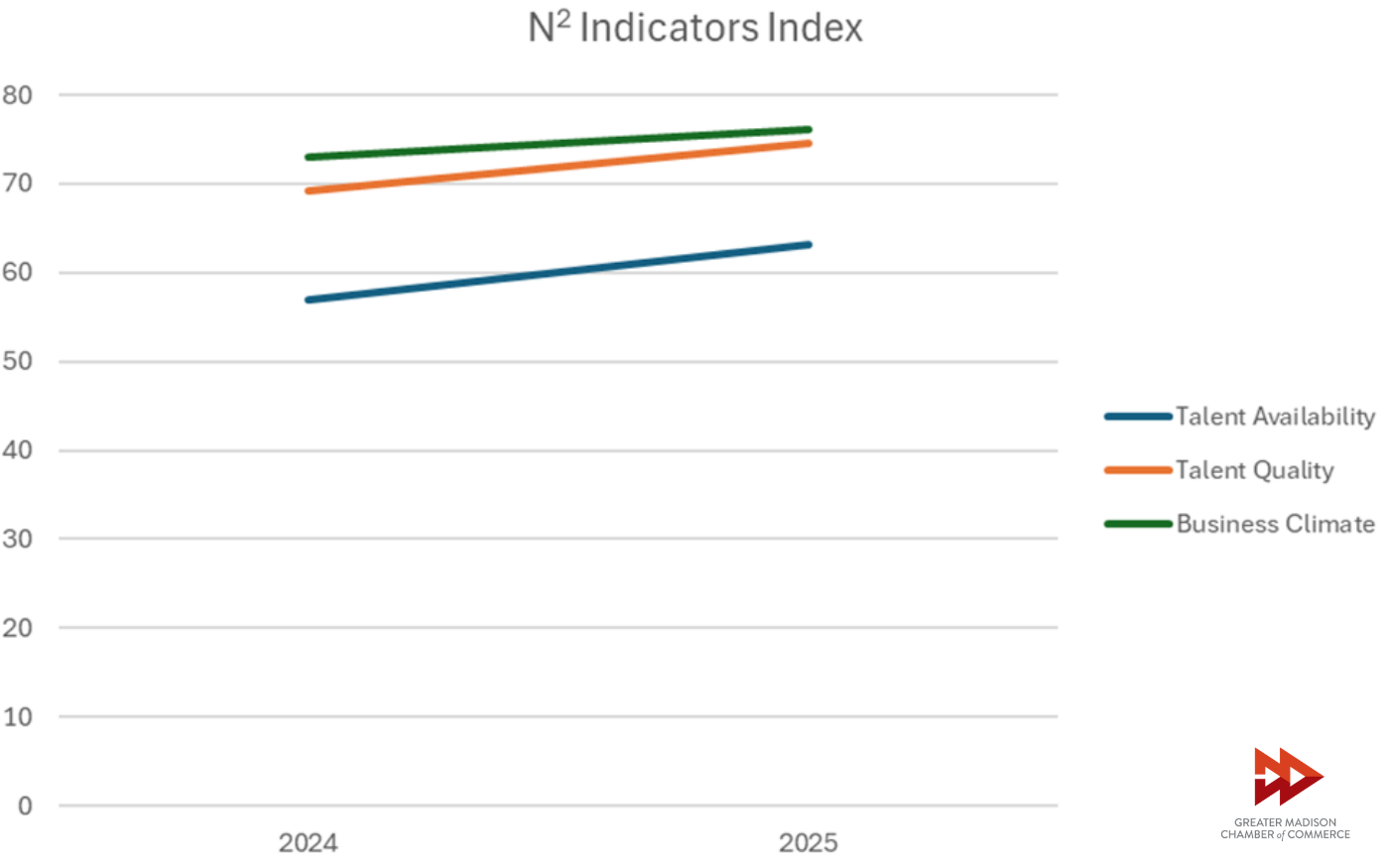

Another way to visualize and understand the difference between 2024 and 2025 ratings for these indicators is by creating an index (Fig. 4) to measure the difference between how many businesses rated these indicators above average or better and how many rated them below average or worse. The index scales from 0 to 100, with 0 meaning every business rated it negatively, 50 meaning an equal number of businesses rated it positively and negatively and 100 meaning every business rated it positively.

All three indicator indices are above 50 in both survey years, indicating that more businesses felt positively than negatively about the indicators. All three also increased between last year and this year, demonstrating improvement.

How Does Greater Madison Measure Up?

Recently, the U.S. Chamber of Commerce released its 2025 Empowering Small Business Report, which summarizes the results of a national survey of small businesses. The U.S. Chamber defines small businesses as those with fewer than 250 employees, which differs from how the N2 survey categorized businesses. To get the closest approximation for this comparison, we will define Greater Madison’s small businesses as those with fewer than 200 employees.

This year’s Empowering Small Business report focused on AI and how small businesses are using it. According to the report, 40% of small businesses were using AI in 2024, rising to 58% in 2025. AI use among Greater Madison small businesses was 48% in 2024 and 75% in 2025, showing faster AI adoption locally. Similarly, a moderately higher percentage of Greater Madison small businesses are developing custom AI tools compared to the nation.

An additional survey we can use to compare AI trends is McKinsey’s State of AI 2025 report. This report found that although a majority of companies use AI, its use is concentrated in the “experimenting” and “piloting” phases. Just one-third of businesses said their AI use was “scaling” or “fully scaled.” This is similar to the results from N2, where 58% of businesses said that AI was only “minimally integrated” into their workflows.

Tariffs and Uncertainty

Two significant findings from this year’s survey were the proportion of businesses concerned about tariffs and those facing more uncertainty this year than last year (Fig. 5). The proportion of respondents that listed tariffs as a barrier to their business increased from 5% in 2024, representing the least common barrier, to 36% in 2025, the third-highest barrier. A majority (51%) of surveyed businesses said they were experiencing more uncertainty this year than last year.

The industries most concerned about tariffs this year were retail, advanced manufacturing, arts and entertainment, and construction and trades. While it is not surprising to see industries that are import- or export-dependent identify concerns about trade and tariffs, it is notable that 50% of arts and entertainment businesses that took the survey identified tariffs as a top barrier.

The industries that said they were facing more uncertainty than last year were nonprofit, arts and entertainment, business and professional services, retail, and bioscience. Bioscience employers faced only slightly more uncertainty than the general sample, but because it is a driver industry for the region’s economy, it is worth noting and tracking.

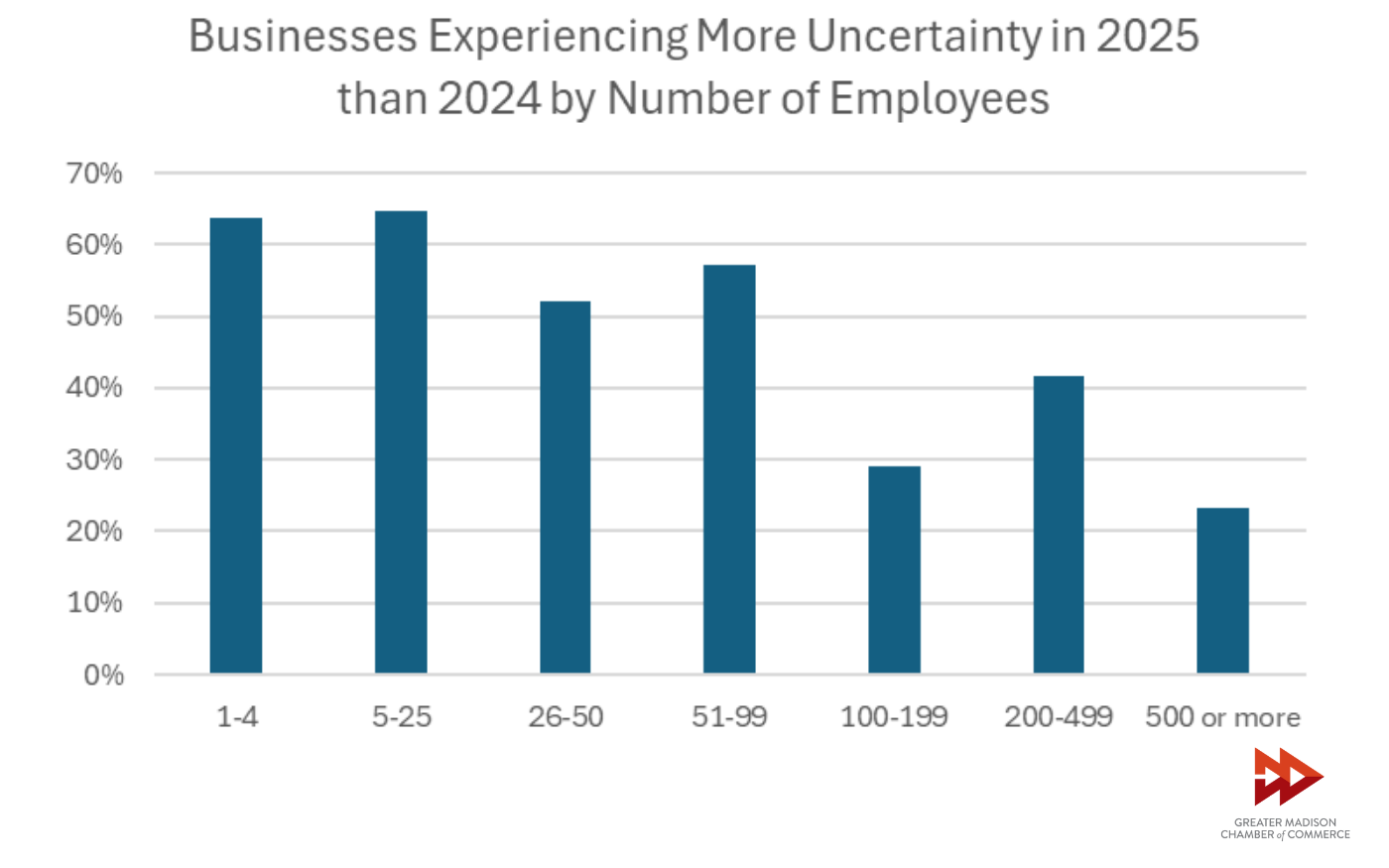

Business size also had a large effect on whether businesses reported facing more uncertainty, with more than 60% of smaller businesses reporting increased levels of uncertainty while less than 30% of larger businesses reported the same.

Photo by Richard Hurd

Metro Metrics October 2025

Metro Metrics is a monthly data snapshot that explores key economic indicators reflecting the health of the Madison metro economy.

Madison’s Export Markets

In this month’s Metro Metrics, we examine Greater Madison’s export activity to better understand the region’s economic connectivity to global markets.

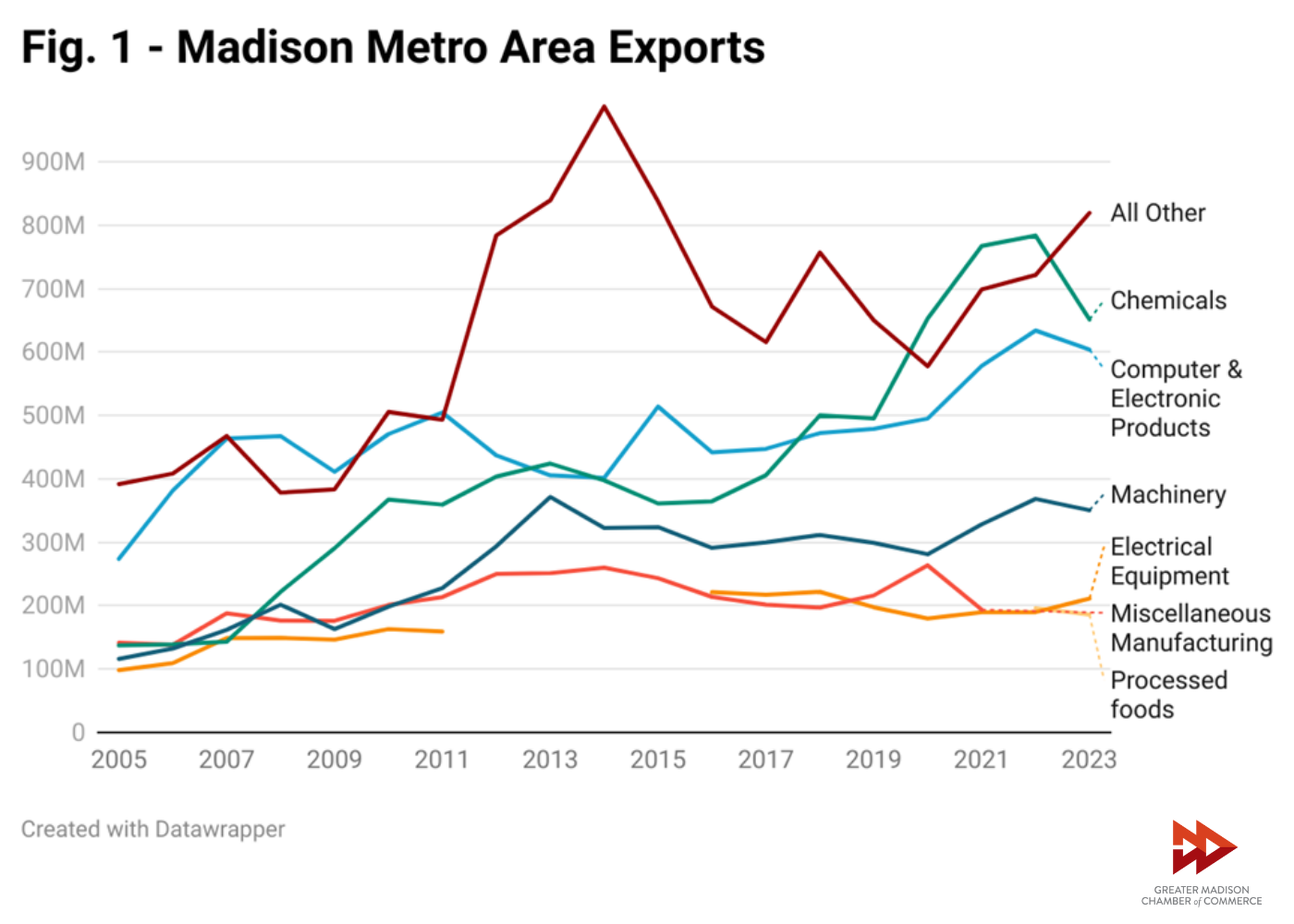

In 2023, the top five categories of goods that the Madison Metro exported were chemicals, computer and electronic products, machinery, electrical equipment, and processed foods (Fig. 1). Processed foods was a recent addition to the top five, displacing miscellaneous manufacturing. Chemicals are the largest export category by total dollar amount, making up roughly 23% of Greater Madison’s total exports, followed by computer and electronic products at 21%. These two categories account for nearly half of the Metro’s total foreign exports of $2.9 billion in 2023. Total exports have been increasing over time. Exports as a proportion of the Metro’s GDP have remained roughly constant, fluctuating between 4% and 6% since 2005.

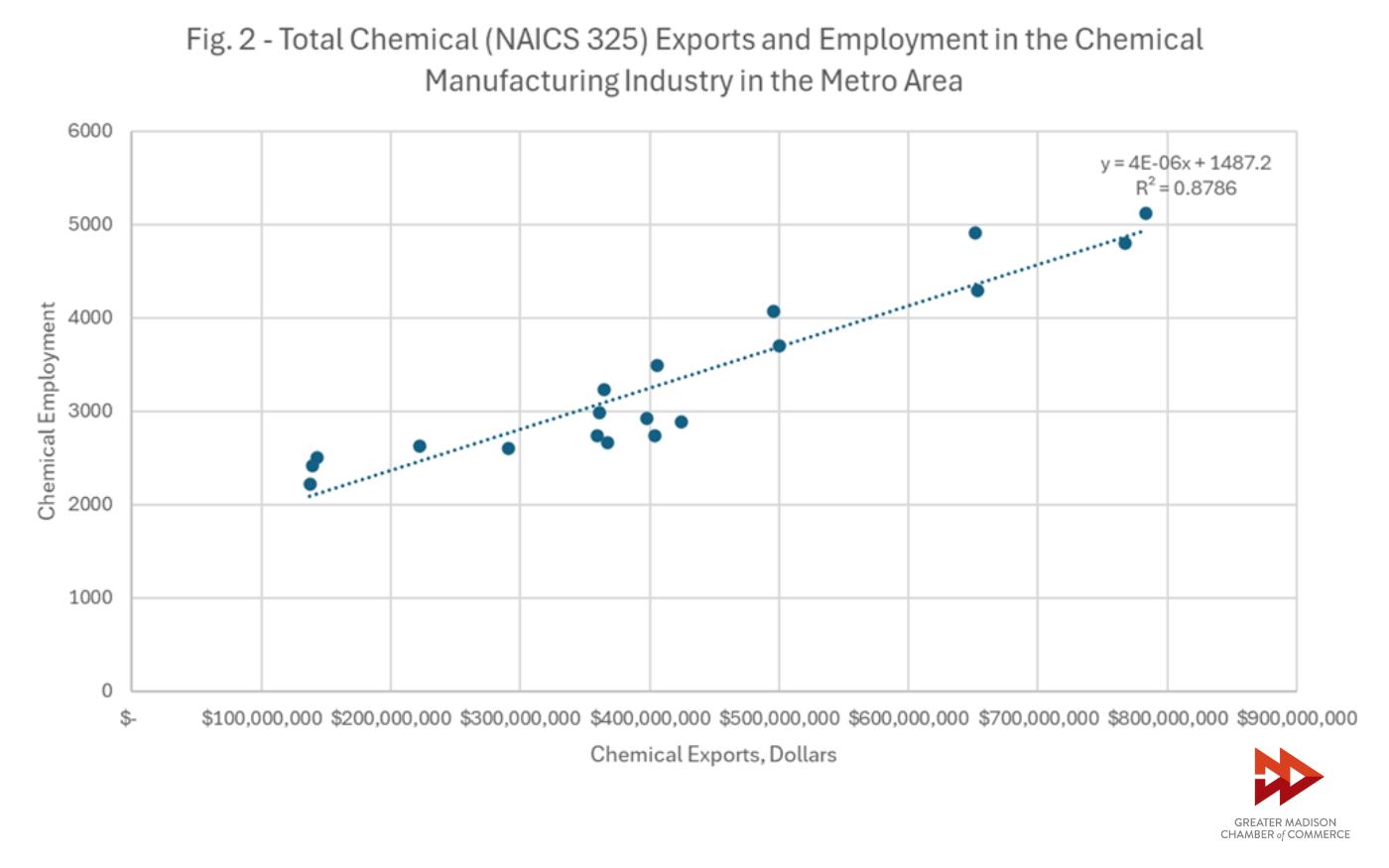

The value of these exports lies not just in the dollars they bring to the region, but also in their employment effects. Fig. 2, which graphs total chemical exports from the Madison Metro plotted against regional employment in the chemical manufacturing industry, shows a strong correlation (R^2=0.88) between the two. The least-squares regression indicates that, on average, every $250,000 in chemical exports from the Madison Metro supports one additional job in the chemical manufacturing sector. The chemical manufacturing NAICS code includes many different subsectors, including pharmaceuticals and medicine, which is part of Greater Madison’s renowned Biohealth ecosystem.

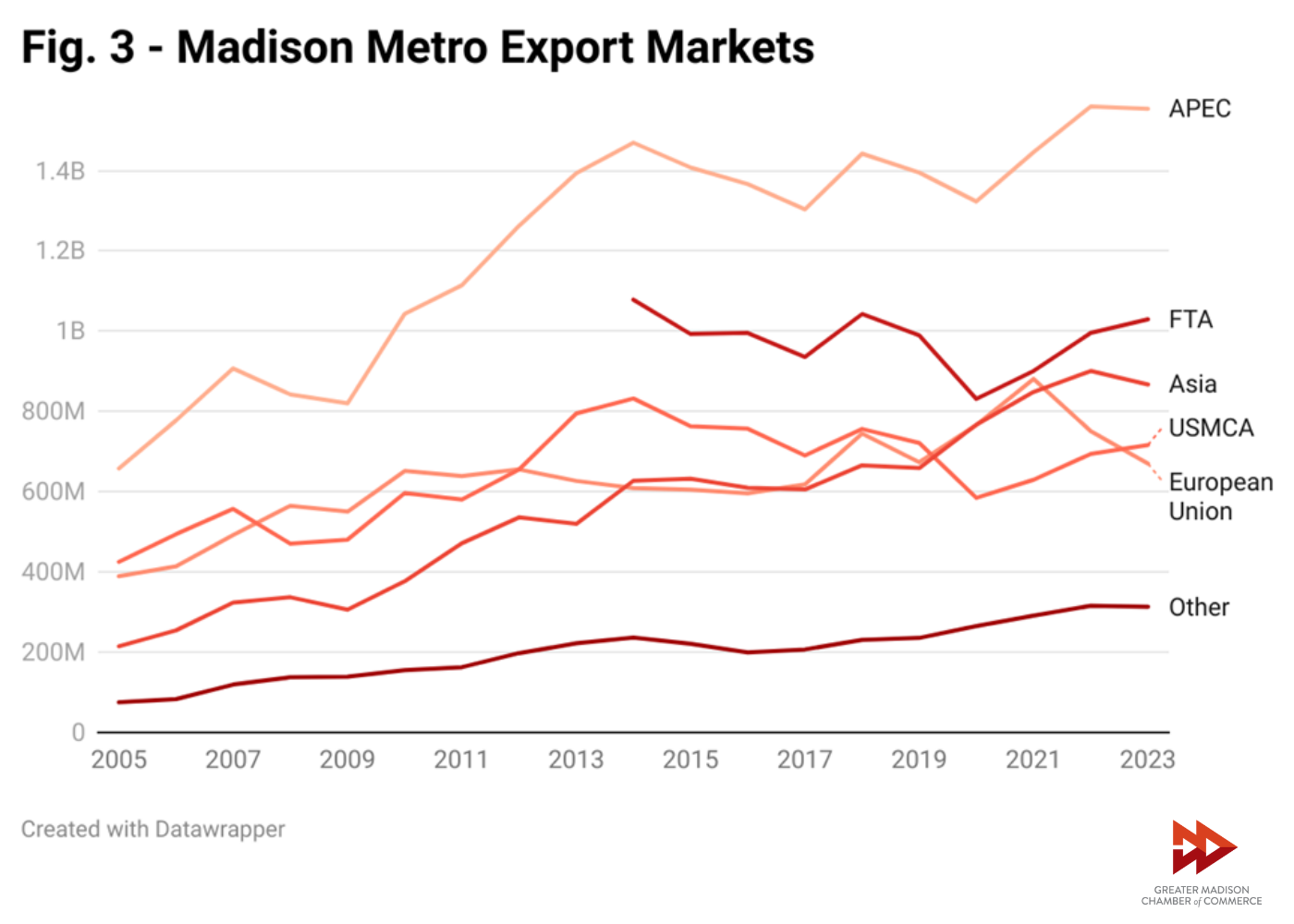

Based on trade data published by the ITA (Fig. 3), the largest group of countries Greater Madison exports to is the Asia-Pacific Economic Cooperation (APEC), which includes most nations bordering the Pacific. In 2023, this group of 20 nations was the destination for more than half of Greater Madison’s exports and has accounted for between 52% and 62% of the Metro’s exports since 2005. Two of the nations in APEC, Canada and Mexico, are also part of the United States-Mexico-Canada Agreement (USMCA). In 2023, the USMCA countries received roughly one-quarter of Greater Madison’s exports, a proportion which has ranged between 22% and 38% since 2005.