Category: Expansions/Relocations

Photo by Richard Hurd

Per Mar Security Services Expands in Northern Wisconsin

Contact:

Jennifer VanGenderen, Per Mar Security Services

563-344-7313

FOR IMMEDIATE RELEASE

August 9, 2022

Per Mar Security Services Expands in Northern Wisconsin

DAVENPORT, Iowa – Per Mar Security Services, the largest family-owned, full-service security company in the Midwest, is pleased to announce it has acquired Dream System’s security division further expanding its customer base in Northern Wisconsin.

For the past 22 years, Seth and Nicki Ferrin have owned and operated Dream Systems. In the announcement to their security customers, they said, “As many of you know, Nicki and I have pursued some of our personal goals and involved ourselves heavily in our volunteer work. We felt the need to merge our security division with a company that shares our goals, ethics, and drive to succeed. Per Mar, a family owned business like ours, is the perfect match. Your safety and security of your home and business intrusion systems will continue to be their focus. We are retaining our IT division of Dream Systems IT. IT has been our niche for a very long time. With this new merger, we can focus solely on one vertical. We are very excited to continue this path with our IT team.”

The acquisition is a great fit for Per Mar as the company has branch locations in both Minocqua, WI and Schofield, WI. “Dream Systems has a very loyal client base in Northern Wisconsin, and we look forward to serving these customers for years to come,” said Brian Duffy, CEO of Per Mar. “We already have a great customer base in that area, and some really exceptional employees.”

About Per Mar Security Services

Established in 1953, Per Mar Security Services is the largest, family-owned, full-service security company in the Midwest with more than 2,800 team members, operating in 25 branch locations. The company provides full-service security solutions for homes and businesses including security officer services, smart home automation, burglar and fire alarms, access control, security cameras, alarm monitoring, investigative services and background checks. For more information about Per Mar Security Services, please visit permarsecurity.com.

Photo by Richard Hurd

Fleetworthy Solutions: There’s No Place Like Home

Madison, WI, June 28, 2022 – Since rebranding back in 2017, Fleetworthy Solutions has seen their number of clients, strategic partners, and employees increase year after year. Furthermore, after 8+ years of sharing a building with several other businesses, Fleetworthy has now increased their square footage and has a building of their very own to call home!

Photo by Richard Hurd

Symbiont Joins Mead & Hunt

Symbiont, an engineering, procurement, and construction (EPC) firm based out of Milwaukee, Wisconsin, joined Mead & Hunt, a Top 100 national architectural-engineering firm, on June 1st, 2022. With this merger, Mead & Hunt is now the largest engineering firm in Wisconsin, according to the Milwaukee Business Journal’s latest data. The move allows both Mead & Hunt and Symbiont to expand their geographic and market reach on a national level, specifically in the areas of water, renewable energy (biogas), and food and beverage.

“This merger not only holds enormous benefit for both our companies, but for our clients as well,” said Andy Platz, CEO and President of Mead & Hunt. “We continuously work to provide our clients with new and expanded services. This move combines Mead & Hunt’s and Symbiont’s resources and project experience to support and grow our food and beverage and municipal markets.” He continues, “This union represents an ideal cultural fit. Both companies share values that put our communities, clients, partners, and employees first.”

Symbiont is an engineering, design-build, and construction firm founded in Milwaukee, Wisconsin in 1981. By developing and implementing innovative engineering technologies to optimize environmental and sustainable solutions, they have grown steadily in size, offerings, and geography.

Joining forces with Mead & Hunt allows Symbiont to offer clients expanded services along with the benefits of a national, full-service firm. Similarly, Mead & Hunt clients will reap the benefits of Symbiont’s design-build, renewable natural gas (RNG), and process design experience.

“Our vision for Symbiont’s future made this the perfect fit,” said Tom Bachman, previously CEO and President of Symbiont and now Group Leader at Mead & Hunt. “With expanded resources and a greater geographic and market reach, we can better holistically serve our current and future clients. In addition, Mead & Hunt shares our strong commitment to sustainability and growth to make our planet better, one project at a time.”

Founded in Wisconsin in 1900, Mead & Hunt has since expanded significantly in size and geographic reach. The firm now provides diversified services nationwide and ranks #91 on ENR’s Top 100 Design Firms. With a team of over 1200 professionals in more than 40 offices across the US, Mead & Hunt supports several key markets, including aviation, transportation, food and beverage, federal, state and local governments, and water.

XXX

ADDITIONAL INFORMATION

Additional quotes or background information

- Andy Platz, Mead & Hunt CEO/President

andy.platz@meadhunt.com

608-443-0600 - Tom Bachman, Mead & Hunt Group Leader/Former Symbiont CEO/President

tom.bachman@meadhunt.com

414-755-1137

General media inquiries and photo requests:

- Meghan Stiklestad, Marketing Director

meghan.stiklestad@meadhunt.com

608-443-0378

Additional references

- Mead & Hunt website: www.meadhunt.com

- Symbiont website: https://www.symbiontonline.com/

Photo by Richard Hurd

Madison Ace Hardware: ‘We look forward to becoming a helpful and valuable neighbor to the community’

A new Ace Hardware store opened in Madison, Wisconsin, on Monday, May 23.

The store is located at 209 Cottage Grove Road and will bring “personal, knowledgeable and helpful service” to the residents of Madison, according to a press release.

“Our mission is to provide customers with the neighborly advice and assistance they have come to expect from Ace,” Ace officials said. “We look forward to becoming a helpful and valuable neighbor to the community, both inside and outside the walls of our store.”

Photo by Richard Hurd

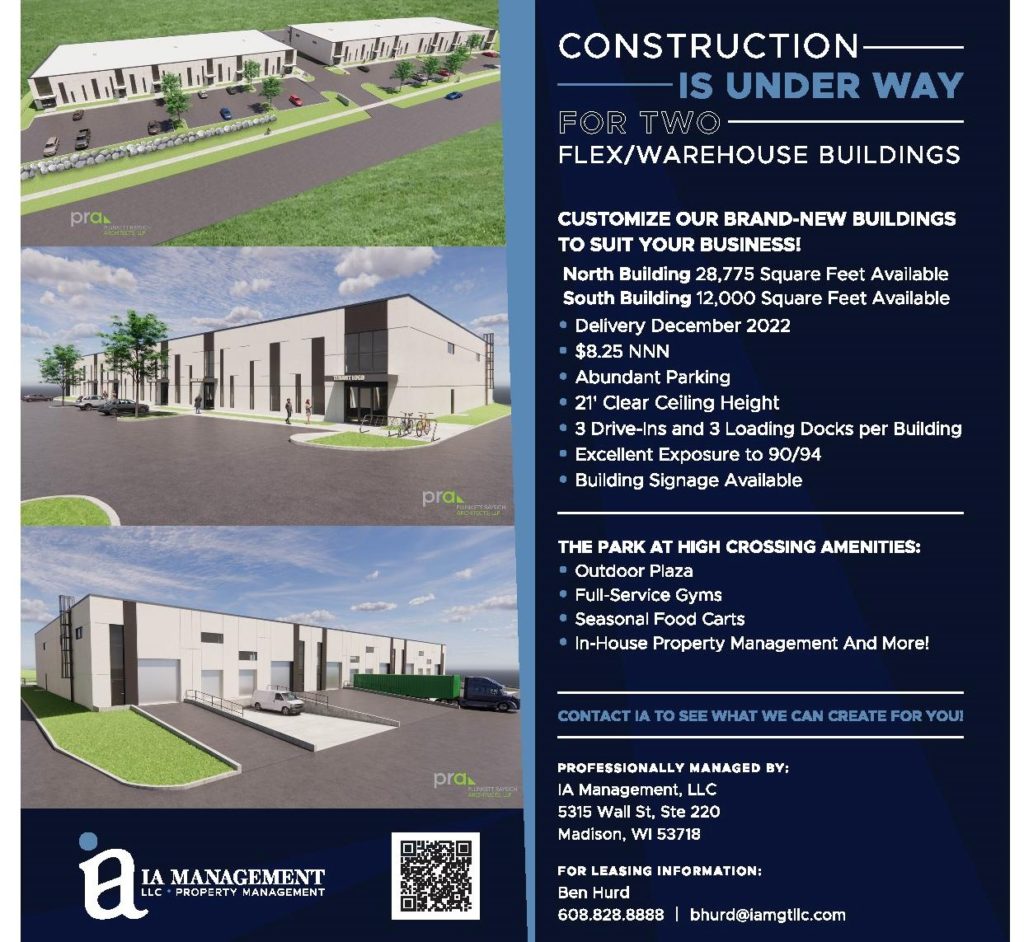

Investors Associated LLP: Construction Underway on New Commerce Building