Category: Member News

Learn who’s growing, changing, moving and more! Stay on top of what’s new with your neighboring businesses. We share news releases and announcements from your peers in the Madison area. Want to toot your own horn? Use our Submit Member News form to share your own stories.

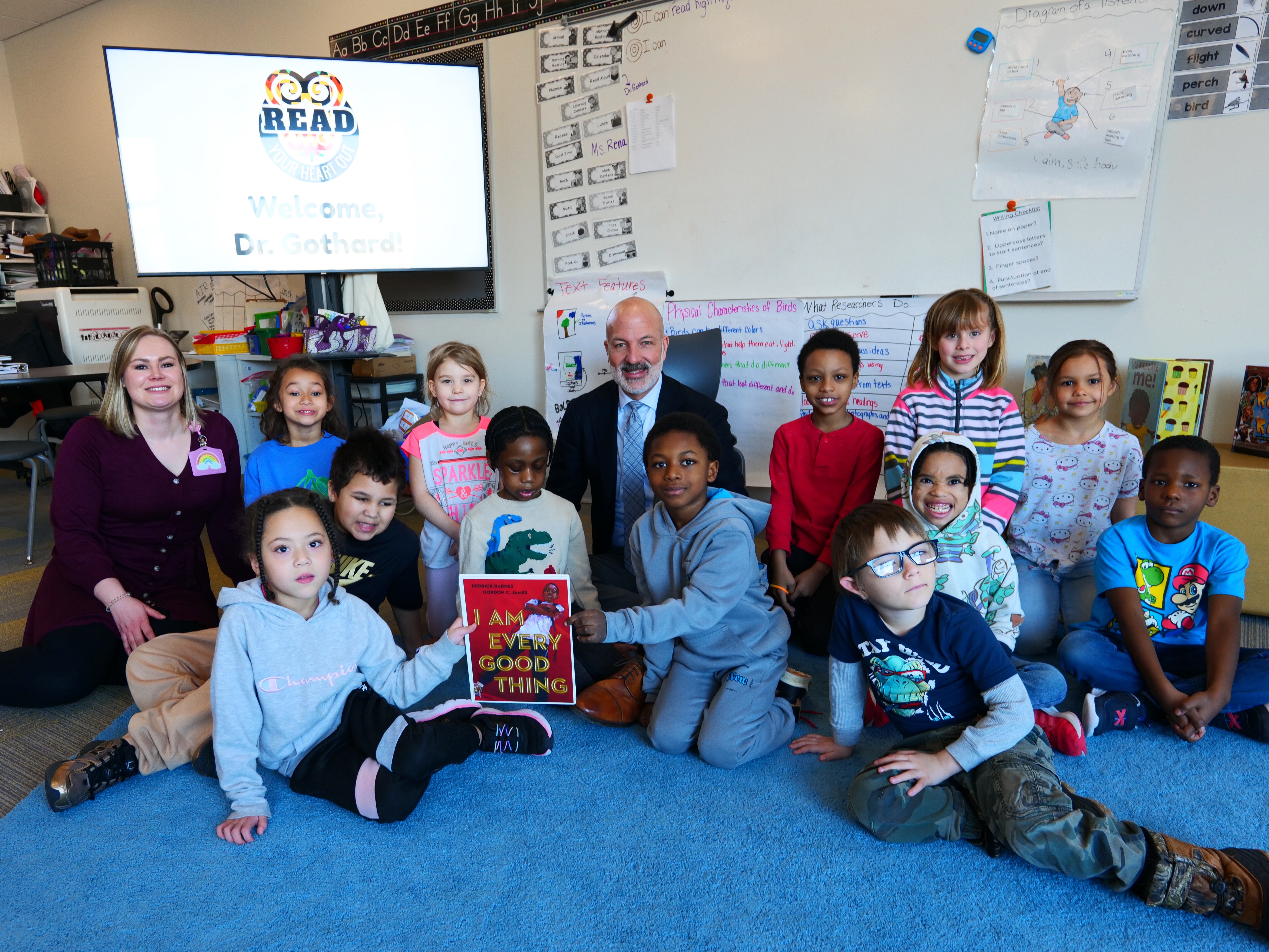

Photo by Richard Hurd

“Read Your Heart Out” Returns for 22nd Year Across MMSD Schools

MADISON, Wis.—The Madison Metropolitan School District (MMSD) is marking the 22nd year of “Read Your Heart Out,” a districtwide literacy initiative that brings students, families and community members together through storytelling and shared cultural experiences.

Rooted in traditions that honor heritage, voice and intergenerational connection, the program centers African American and Black readers who volunteer their time in classrooms, sharing books, poetry and personal narratives that encourage students to see reading as both empowering and joyful.

Each celebration is designed to strengthen relationships between schools and the communities they serve while reinforcing the importance of representation, identity and belonging in literacy development.

The 2026 theme, Ujima, reflects the Kwanzaa principle of collective work and responsibility, highlighting the shared role schools, families and communities play in supporting student success and building strong learning environments.

“‘Read Your Heart Out’ is more than just a fun event,” said Tyson Jackson, MMSD director of Family, Youth & Community Engagement. “It’s about fostering a lifelong love of reading, nurturing curiosity and empowering students to explore the world through books.”

Held in recognition of National African American Parent Involvement Day, the initiative also honors the leadership, advocacy and partnership families bring to schools each day. This year’s district kickoff was hosted virtually by Jackson and streamed to classrooms via MMSD’s YouTube channel, allowing students across elementary schools to participate simultaneously.

“Events like ‘Read Your Heart Out’ highlight what makes our schools so special,” Superintendent Joe Gothard said. “When families and community members step into classrooms as readers and role models, students see firsthand that literacy, culture and community are intertwined. That visibility and connection leave a lasting impression.”

Since launching at Midvale Elementary School in 2004, the initiative has expanded into a districtwide effort, with elementary schools across MMSD hosting celebrations that welcome guest readers and volunteers.

In the weeks ahead, schools will continue site-based programming that includes classroom read-alouds, cultural storytelling, literacy activities and opportunities for family engagement.

Community members interested in volunteering or learning more about school-based events are encouraged to contact MMSD’s Family, Youth & Community Engagement department via Let’s Talk for additional information.

###

About the Madison Metropolitan School District

The Madison Metropolitan School District (MMSD) is the second-largest school district in Wisconsin, serving more than 25,000 students across 52 schools. The district’s vision is that every school will be a thriving school that prepares every student to graduate ready for college, career and community. With more than 6,000 teachers and staff, MMSD is committed to ensuring the district’s goals and core values are held at the center of its efforts, so students can learn, belong and thrive. For more information, visit mmsd.org.

Photo by Richard Hurd

The Carnelian Collection opening reception

Madison, Wisconsin, Feb. 2 – Carnelian Art Gallery, located at 221 King St., Suite 102, in downtown Madison, is pleased to announce its first art exhibition of the year, titled “The Carnelian Collection.”

This exhibition is dedicated to the artists whose works have become part of the gallery’s growing permanent collection, and is a general celebration of their respective imaginations – each artist brings something distinctive to bring to the table in terms of style, aesthetic, message and medium.

Participating artists include Chuck Bauer, Amanda Langer, Kevin Kiley, James Widder, Dylan Waddell, Nastia Craig and Daniel Fleming.

The Carnelian Collection exhibition is slated to kick off with an opening reception at 5 p.m. on Friday, March 6, and is to be on display until Friday, March 27. As always at Carnelian Art Gallery, admission on opening night is free, and light refreshments will be served.

At 6 p.m. on opening night, Bauer will deliver an artist talk regarding paintings of his the gallery recently added to its collection. This is a talk prospective visitors will not want to miss.

“I am both flattered and honored to be part of Madison’s premiere downtown commercial fine art gallery,” says Bauer.

Bauer employs logic when creating his works. His painting process has a clear beginning, middle and end. Beginning usually involves a canvas on which he has painted an opaque color, like bright red. Then comes a simplified charcoal outline of what Bauer wants to paint using photos or by working outdoors for reference. He tends to gravitate toward natural and representational subjects, like landscapes and the built environment. After the initial charcoal drawing, Bauer adds a dark and light value using acrylic paint.

Finally, he applies oil paint over the acrylic to bring out the true quality of the scene he’s painting.

Sometimes, Bauer will take more liberties, adding his own personal flair to a normally banal landscape. A winter setting might become a whimsical autumn one. And sometimes, that decision isn’t even up to Bauer, he said, as his creations often reveal themselves to him on their own.

He originally grew up in Philadelphia. He discovered his passion for art at university. Bauer is a 1965 graduate of The William Penn Charter School out of Pennsylvania. In 1966, he studied art history in Paris, France, for a summer.

Bauer went on to receive in 1968 his undergraduate degree at Ohio Wesleyan University. He then obtained his graduate degree in fine art from the University of Wisconsin-Madison in 1969. In 1972, Bauer opened The Soap Opera, a gift retail store, which now operates on State Street in downtown Madison (just a hop and a skip from the gallery), with his husband, also named Chuck Beckwith.

Together, the couple operated the business until 2016, when they sold it. During that time, Bauer refined his artistic process by working with mentors, taking workshops, and experimenting with different techniques on his own. He continues to do so in his retirement, most often turning to en plein air and other forms of traditional, representational easel painting.

“The artists in this exhibition are more than artists,” says Emilie Heidemann, Carnelian Art Gallery marketing director. “They are our friends. They work hard. And they deserve every opportunity in the world to be celebrated for the blood, sweat and tears they put into their creations – especially now.”

More about each artist

Widder has always had “creative talent which I believe I inherited from my father, who is also an artist. I was born and raised in Minneapolis, Minnesota. Because my family saw I had talent around the age of 8, I began doing creative projects with my family friend and artist Scott Bean. I did drawing, sculpture, painting and printmaking. Upon beginning my junior year of high school, I was accepted to the Perpich Center for Arts Education, an arts high school in my hometown. I’ve been creating art my entire life. I moved to Madison in 2011 where I now live on its east side and continue to create.”

Langer “studied both sculpture and natural resources at the University of Wisconsin-Stevens Point, earning her undergraduate degree in fine art 2017. She spent the following years working in ecological restoration and landscaping with native plants. Her artwork is informed by her experiences in this field, and is especially focused on exploring conflict between industry and nature, systems and people, and within the self. She was previously a resident artist at Wisconsin Art Hub in Cambridge, has shown her work in gallery spaces around Wisconsin and has completed public works for the Stevens Point Sculpture Park, Hart Park in Wauwatosa, Wisconsin. Langer also completed commissioned artwork for the Rochester Art Center. She has been awarded at the Art Fair Off the Square, Stevens Point Festival of the Arts, and the Mary Hoard Art Show.”

Craig is a “visual artist based in Madison, Wisconsin. Born in Odessa, Ukraine, her work explores abstraction through layered compositions that balance intuition, structure and emotional nuance. She works primarily with painted polyester film, acrylics, inks and mixed media, assembling surfaces that hold tension, movement and quiet resilience. Her process is exploratory and intuitive, allowing forms and relationships to emerge through making. Craig’s work has been exhibited throughout the Midwest and beyond and is held in both private and public collections. In addition to her studio practice, she is an independent interior designer and creative lead who collaborates closely with local architects. Her work in this role may be familiar to the public through projects such as Sushi RED, Jacknife, and Forage Kitchens (Middleton).”

Fleming’s paintings, according to his website, “explore ideas of isolation, connection, introspection, loss, distance and an overwhelming sense of the unknown, resulting in an enveloping world of symbol, color, and surreal landscapes populated by mysterious, yet oddly familiar, figures. The paintings take form organically through a process of discovery rather than pre-planning. Marks are made, surfaces are built, and eventually, scenes and figures emerge naturally and unexpectedly. This meditative process, an almost abstract approach, reveals thoughts, emotions and ideas that connect to the everyday, yet also stand on their own as representations of the human experience that all viewers can find solace and connection within.”

Waddell grew up in Columbus, Wisconsin, and now lives and works in Madison. Waddell paints and makes his collages on the same easel he bought at Goodwill over 17 years ago. His main goal in creating is to build interesting compositions rather than to convey ideas. Waddell wholeheartedly tries to make art for no one but himself. His new body of collages are an attempt to break free from the figures that have generally dominated his painting practice, while committing to a more free- flowing and spontaneous form of expression. Waddell builds up compositions while breaking them down simultaneously.

Kiley was “raised in a rural area south of Stoughton, Wisconsin. He received recognition for art at an early age in the local newspaper, and was voted “most artistic” in high school. Later, he received his undergraduate degree from the University of Wisconsin Eau-Claire, then worked in Chicago for two years. Kiley has worked as an independent painting contractor doing home improvements in the Madison area for 20-plus years. Many projects are on historical houses. He creates his own paintings in his free time, and also plays improvisational guitar. Kiley has exhibited in Stoughton, Eau Claire, Chicago and Madison throughout his lifel. Currently residing in Stoughton, Kiley embraces the local landscape where he grew up. He is inspired by tobacco sheds, marshlands, and weathered edges of towns, visiting or viewing at dusk, twilight or after dark. Kiley mostly applies acrylic paint, also oil and watercolor paints, charcoal and chalk pastel, pencil and ink. A variety of media keeps him entertained and excited about the process of making art.”

“Carnelian Art Gallery is beyond thrilled to kick off its third year of exhibitions,” says Evan Bradbury, Carnelian Art Gallery owner and head curator. “We hope you join us as we aim to celebrate the artists that make up the Carnelian Collection.”

Photo by Richard Hurd

Capitol Bank Announces Promotions for Kari Harpold and Zach Wienke, Positioning for Expanded Success

Madison, WI (February 5, 2026): Capitol Bank is pleased to announce promotions for Kari Harpold and Zach Wienke, in recognition of their exceptional service to the Bank and its customers.

Kari Harpold has been named Assistant Vice President, Treasury Management Officer. During Kari’s 11 years with the Bank, she has provided a high level of customer service to numerous business clients. She has been a subject matter expert for business deposit accounts and treasury management offerings.

“We appreciate Kari’s hard work through the years and her dedication to our clients. Her expertise and service-oriented mindset have long been a deep value to both our organization and to our clients,” said Justin Hart, CEO.

Zach Wienke has been promoted to Retail Development Manager at the Bank’s East location. Zach has proven himself as a trusted leader to his team and consistently exceeded his goals. He will join an already strong team at the Bank’s newest location.

“Zach’s excellent customer service and banking knowledge have been an asset to our team. We’re excited to see him develop and help grow our East location business presence while also partnering with our established customer base,” said Ami Myrland, President and CFO.

About Capitol Bank: Capitol Bank, locally owned and operated, is committed to serving the communities in which we live, work, and do business. We are proud of the partnerships we have established with organizations, businesses, and individuals in the Greater Madison area. Our philosophy of community support is demonstrated at the corporate level, as well as in the time and energy our employees devote to our community each year. Capitol Bank is Member FDIC and an Equal Housing Lender.

Photo by Richard Hurd

Dupaco President & CEO Joe Hearn named CUES Outstanding Chief Executive

Dubuque, Iowa—Dupaco Credit Union President and CEO Joe Hearn has been named Credit Union Executive Society (CUES) Outstanding Chief Executive, one of the industry’s highest individual honors. The award recognizes a CEO who demonstrates visionary leadership, organizational transformation, strong advocacy for the credit union movement and an unwavering commitment to members, employees and community impact.

CUES selects its Outstanding Chief Executive based on a leader’s ability to strengthen their organization, champion people development, drive sustainable innovation and meaningfully improve member financial well-being. Hearn’s recognition reflects the significant progress Dupaco has made under his leadership and his influence throughout the broader credit union system.

“Joe leads with unparalleled expertise and a big heart,” said Ellen Goodmann Miller, Dupaco Credit Union Board Chair. “Under his direction, Dupaco has become a beacon of opportunity, equity and community building across Iowa and beyond.”

Hearn has led the financial cooperative since 2012. During this time, the credit union experienced sustained growth, with membership increasing from 68,000 to more than 179,000, assets expanding from $1.06 billion to $3.5 billion, and Dupaco’s service area broadening from 28 to 118 counties—a reflection of both strategic expansion and growing member trust.

Hearn’s community‑focused vision has also created a meaningful and lasting impact. In 2025, Dupaco employees contributed 6,136 volunteer hours, many utilizing the credit union’s volunteer time‑off benefit to support organizations important to them. He also championed the rehabilitation of the Dupaco Voices Building, transforming a once‑deteriorated historic structure into a modern operations center that now serves as a catalyst for neighborhood revitalization.

Under Hearn’s leadership, Dupaco continues to invest deeply in its people and members. In 2025, the credit union delivered 226 employee training sessions totaling more than 16,000 hours, reinforcing a culture of continuous learning and professional growth. Dupaco’s emphasis on expert monitoring, member education and advanced technology helped prevent more than $10.5 million in potential member fraud losses in 2025 alone—demonstrating Hearn’s commitment to safeguarding member financial well‑being.

“Joe’s superpower is empowering people—he creates a place where employees thrive, where members are truly seen, and where purpose drives every decision,” added Goodmann Miller. “It is truly an honor to celebrate this well‑deserved recognition.”

Hearn is a nationally respected industry leader and a Certified Chief Executive through CUES. He has chaired both the Iowa Credit Union League and CUES, and in 2019 was inducted into the CUES Hall of Fame for lifetime service to the credit union movement.

The CUES Outstanding Chief Executive Award was presented to Hearn at the CUES Symposium on February 2, 2026.

###

About Dupaco Community Credit Union

Dupaco Community Credit Union is a not-for-profit, member-owned financial cooperative headquartered in Dubuque, Iowa. It is dedicated to the financial well-being of its members, and specializes in personalized financial counseling, money advice and education. It offers savings, loans, investments, insurance and wealth management products for individuals and businesses. Dupaco serves residents in 118 counties throughout Iowa, northwest Illinois and southwest Wisconsin. Founded in 1948 by ten Dubuque Packing Company employees, membership has grown to more than 178,000 with assets exceeding $3.5 billion. It has over 600 employees and 23 branch office locations. It is a Forbes Best-in-State Credit Union, Forbes America’s Best Small Employer, and a Des Moines Register Top Workplace. Learn more at www.dupaco.com.

About CUES

For over 60 years, CUES has advanced the credit union movement by developing exceptional purpose-driven leaders who meet the unique needs of their organizations and the communities they serve. CUES partners with credit unions to elevate the leaders of today and tomorrow through exclusive networking and event opportunities, programs that facilitate personal and professional development, and unmatched digital and in-person learning experiences. Visit CUES.org to learn how CUES plays a pivotal role in shaping the future of credit unions.

Photo by Richard Hurd

MMSD to Host Free Vaccination Clinic Saturday Following Confirmed Measles Case in Madison

MADISON, Wis.—In response to a confirmed case of measles in Madison, the Madison Metropolitan School District (MMSD), in partnership with Public Health Madison & Dane County (PHMDC) and local health care providers, will host a free measles, mumps and rubella (MMR) vaccination clinic this Saturday to support the health and safety of the community.

At this time, there are no confirmed cases of measles within MMSD schools.

The free vaccination clinic will be held at Holtzman Learning Center (333 Holtzman Rd., Madison, WI 53713) on Saturday, Feb. 7, from 10 a.m. to 2 p.m., and is open to individuals ages 5 and older. To help ensure adequate staffing and vaccine availability, families are encouraged to make appointments through PHMDC’s website.

In addition to MMR, vaccines for influenza; tetanus, diphtheria and acellular pertussis (Tdap & DTaP); meningococcal disease; human papillomavirus (HPV); hepatitis A; hepatitis B; polio; and varicella (chickenpox) will also be available.

“As a school district, our priority is to keep students, staff and families healthy and informed,” said Sarah Breon, MMSD director of health services. “Vaccination is one of the most effective ways to prevent the spread of measles and other diseases, and this clinic is an important step in making that protection accessible to our community.”

The district has established protocols in place should a confirmed case occur at a school, consistent with guidance from Public Health Madison & Dane County and the Wisconsin Department of Health Services. These protocols include exclusion from school for up to 21 days for individuals who are not fully vaccinated, verification of immunity for those who are vaccinated and direct communication with any exposed staff and families.

“MMSD works closely with public health partners to respond quickly and thoughtfully when health concerns arise,” Breon said. “Our goal is to limit disruption to learning while taking the steps necessary to protect everyone in our buildings.”

Families with health-related questions are encouraged to contact their school nurse or MMSD Health Services. Staff members with personal health questions should contact their health care provider.

More information about the vaccination clinic, immunization requirements and measles prevention is available through PHMDC and the Wisconsin Department of Health Services.

###

About the Madison Metropolitan School District

The Madison Metropolitan School District (MMSD) is the second-largest school district in Wisconsin, serving more than 25,000 students across 52 schools. The district’s vision is that every school will be a thriving school that prepares every student to graduate ready for college, career and community. With more than 6,000 teachers and staff, MMSD is committed to ensuring the district’s goals and core values are held at the center of its efforts, so students can learn, belong and thrive. For more information, visit mmsd.org.