Category: Products

Photo by Richard Hurd

MMSD Board of Education Approves 2025–26 Budget

MADISON, Wis.—The Madison Metropolitan School District (MMSD) Board of Education has approved the district’s 2025–26 budget, which outlines how it will use its resources to support students, staff and families in the year ahead.

The approved budget totals $668 million, with $577.1 million dedicated to day-to-day school operations. This year’s plan reflects a 10 percent increase in both revenue and expenses compared to last year, driven by ongoing investments in staffing, student programs and school facilities.

The district’s total property tax levy (the amount collected in property taxes) will go up by about 20 percent, meaning that the tax rate will increase by about 96 cents for every $1,000 of property value. State aid to MMSD will decrease by about 19.5%. Still, the state will allow the district to receive an additional $325 per student under the revenue limit, providing a bit more flexibility in the overall budget.

The 2025–26 budget keeps MMSD on a strong financial footing, with a projected general fund balance of $78.8 million, which falls within the Board’s targeted range of 12 to 18 percent. The district continues to hold top bond ratings of AA+ and SP-1+, speaking to its continued fiscal stability and responsible use of taxpayer dollars.

Most of MMSD’s budget—about 81 percent—goes toward paying and supporting staff. This year’s plan includes an average 4.95 percent pay increase, made up of a 2.95 percent base wage increase and step increases based on years of service. MMSD will also maintain its current health insurance plans and continue offering full-time benefits to part-time employees who work at least half-time.

“We have worked really hard, especially with rising costs for health insurance and some other things that are out of our control, to prioritize our employees,” said Board President Nichelle Nichols. “I’m really proud of the fact that we have a balanced budget, and that we are in a good position, as stewards of the referendum dollars that our community has entrusted to us, to move this district forward.”

In total, MMSD’s staffing plan for 2025–26 includes approximately 4,246 full-time equivalent (FTE) positions, an increase of about 59 over last year. The district is adding custodial staff to help care for newly renovated buildings, additional building-based substitute teachers, and more staff to support early learning and multilingual education.

Superintendent Dr. Joe Gothard said the budget reflects MMSD’s continued focus on students and staff, beginning with the district’s youngest learners.

“For me, it starts with 4K, which I see as such an important introduction into our district, into community, into the way that staff and principals and teachers receive students and their families,” Gothard said. “A lot of the things that we’re investing in are going to continue to be tied to what our students and families desire, and ensuring that they know we’re making a sustained commitment to listening to them.”

Assistant Superintendent of Financial Services Bob Soldner noted that the 2025–26 budget builds on last year’s successful referendum and provides stability for future planning.

“This budget balances investment in students and staff with careful fiscal management,” Soldner said. “It positions MMSD to meet current needs while planning responsibly for the future.”

The budget continues investments in full-day 4K, early reading instruction based on the science of reading, career and technical education (CTE), daily world language access in middle schools and mental health supports for students.

More information, including the full 2025–26 Budget Book, is available on the MMSD website.

###

About the Madison Metropolitan School District

The Madison Metropolitan School District (MMSD) is the second-largest school district in Wisconsin, serving more than 25,000 students across 52 schools. The district’s vision is that every school will be a thriving school that prepares every student to graduate ready for college, career and community. With more than 6,000 teachers and staff, MMSD is committed to ensuring the district’s goals and core values are held at the center of its efforts, so students can learn, belong and thrive. For more information, visit mmsd.org.

Photo by Richard Hurd

Gallery Night is coming up at Carnelian Art Gallery

UPCOMING EXHIBITION: “Surrealism”

OPENING RECEPTION: 5-8 p.m. on Friday, Nov. 7 (Gallery Night in Madison)

ON DISPLAY: Nov. 7-Dec. 31

EXHIBITING ARITSTS: Kimberly Burnett, Samantha Jane Mullen, Rachael Hunter, Natalie Jo Wright, and Helen Klebesadel

Madison, Wisconsin – Carnelian Art Gallery, located at 221 King St., Suite 102, in downtown Madison, is pleased to announce its last art exhibition of the year, titled “Surrealism,” whose theme is centered around the weird, strange and bizarre. The art in this show takes on a dreamlike and uncanny quality. Some works are two-dimensional, while others are three-dimensional.

Participating artists include Kimberly Burnett, Rachael Hunter, Samantha Jane Mullen, Helen Klebesadel and Natalie Jo Wright.

Surrealism will kick off with an opening reception at 5 p.m. on Friday, Nov. 7, as part of Gallery Night. It is slated to be on display until the end of the year.

Organized by the Madison Museum of Contemporary Art, Gallery Night “offers art lovers and art novices alike an opportunity to enjoy a wide variety of exhibitions, opening receptions, special events and demonstrations at venues throughout the city. During Gallery Night, dozens of venues open their doors to invite the public in to see and shop for original artwork,” according to MMoCA.

As always at Carnelian Art Gallery, admission on opening night is free and light refreshments will be served. And the first 25 visitors to Surrealism’s opening will receive a drink ticket good for one cocktail at Oz by Oz, the gallery’s friend and neighbor at 113 King St. Oz by Oz is known for its zodiac-themed drinks, as well as eclectic and artsy vibe and aesthetic.

At 6 p.m. on opening night, Burnett will conduct a live painting demonstration.

“I am honored to be showing my work at the Carnelian Art Gallery,” said Burnett. “I really enjoy hearing what people take away from my art, and Madison seems to be full of people who appreciate art.”

“I’m really looking forward to live painting and exhibiting in such a beautiful gallery in Madison. My hope is that I get to make new connections which will inspire my future art.”

Burnett is a self-taught artist from North Carolina. Her art is inspired by her childhood love of the old masters of Europe. She taught herself oil paints by studying books on their works and then copying her favorite masterpieces. Today, her works mostly feature lone figures in interior spaces and surreal landscapes with a focus on colors.

She has been painting full time since 2020, when she moved to Milwaukee. In Burnett’s free time, she enjoys gardening, hiking, baking, learning languages and searching for insects.

Surrealism is an exhibition that shines a light on the unconscious mind,” said Carnelian Art Gallery marketing director Emilie Heidemann. “And hopefully, this show will encourage gallery visitors to unlock and explore their respective imaginations, particularly the strange concepts and ideas they drum up sometimes.”

More about each artist

Wright was born in central Illinois in 1977. She received her undergraduate degree in fine arts from the Milwaukee Institute of Art and Design in 1999 and her graduate degree in fine arts from the Rhode Island School of Design in 2008.

Her current series, “Four Eyed Cats in MidCentury Spaces,” grew out of memory, imagination and a lifelong love for mid-century design. Wright’s family (on her mother’s side) owned a furniture store for 50 years in the small town where she grew up. As a child, she spent countless hours wandering its rooms and paging through design catalogues. Years later, rediscovering those same books sparked this series.

The paintings combine nostalgia with playful surrealism: Wright’s two cats, depicted with a “four-eyed” twist, inhabit richly detailed interiors drawn from catalogues, memory, and her own home. Handmade “meat pillows” from an earlier body of work and vintage lamps from her collection collapse past and present, blurring the boundary between real and imagined environments. Originally conceived as an immersive installation, the series still carries that spirit—paintings that feel as though the spaces could spill off the wall and into the viewer’s world.

Wright currently works with water-soluble oils, a medium that has shifted her practice from large-scale portraiture toward finely detailed interiors. Her work reflects both a devotion to mid-century design and a desire to invite viewers into spaces that appear familiar at first glance, but reveal something more curious and uncanny the longer you look.

Klebesadel, who has a graduate degree in fine arts from the University of Wisconsin-Madison, is a visual artist, born and raised in rural Wisconsin near Spring Green. Klebesadel is known for her watercolors focused on environmental and feminist woman-centered themes.

An artist, activist and educator for four decades, Klebesadel’s watercolors push the traditional boundaries in scale, content, and technique. Her paintings are exhibited nationally and internationally. They are also represented in numerous public and private art collections.

Klebesadel was previously a university educator for more than 30 years. Her contributions to the larger arts community included serving as a member of the Wisconsin Arts Board and as the national president of the Women’s Caucus for Art, the nation’s oldest organization of women artists and art historians.She maintains an art studio in Madison, where she continues to grow her artistic vision, build a creative community and support others to do the same by mentoring emerging artists.

Mullen is mostly a sculptor, sometimes a writer and always a curious creature who currently exists in Madison, Wisconsin. Self-taught, Mullen uses polymer clay, paper clay and various other mediums to create playful, yet shocking, narrative sculptures which focus on our connection to the land, society, childhood and monsters. Her work delves into the weird and the curious, the parts of ourselves we correct and mask and the perceived failures that act as building blocks for the walls we build between ourselves, our community and our planet. Each piece is a love letter to the panic attack, the shame shadowed, the glittering and tired, the imagination driven dragon seekers and monster lovers, the playful, hopeful, damned but kind.

Mullen strives to build a mythology within her work that invokes a magical realm in which we are all little monsters exploring the unknown together, inviting the beasts within like wolves to the fire and giving them a little treat.Hunter is a painter based in Madison, Wisconsin. Growing up in Minnesota as an only child, she spent much of her time alone playing make-believe. She continues this practice today by creating paintings that inhabit a world parallel to ours, entirely her own.

Her focus is on creating ambiguous and unsettling narratives that invite viewers to create their own meaning. She works primarily with vibrant oil, acrylic and Flashe paints on alternative surfaces. Wood planks found on the side of the road are intuitively carved into blobs, and bedsheets sourced from second-hand stores, friends, or even her own bed become her canvas.

A key influence in Hunter’s artistic journey is the legacy of the magical realists of the Midwest, such as Sylvia Fein and John Wilde. Like these artists, Rachael uses her paintings to explore and understand an increasingly horrifying reality. With fascism on the rise and a small group of people attempting to control every aspect of daily life, she paints to keep it together and find meaning in it all.

“We are so thrilled to showcase the works of these talented artists,” said Carnelian Art Gallery owner and head curator Evan Bradbury. “This show is all about allowing oneself to be weird and have fun.”

Photo by Richard Hurd

PureTech Home Services Releases Tool to Search Radon Testing Data by Zip Code

PureTech Home Services is releasing a free to use tool for anybody to search their zip code and see the latest radon testing data from the CDC. We display:

- Average and highest radon levels by ZIP and county

- % of tests above EPA recommended action level (4.0 pCi/L)

- % of radon testing between suggested action levels (2.0-4.0 pCi/L)

- Health equivalence visuals (e.g., cigarettes/day, chest X-rays per year, and flights per year)

It’s the most comprehensive databases for any Wisconsinite to see what radon gas levels their community is exposed to on average.

Check out your zip code and county exposure levels here:

https://www.puretechhs.com/radon-wi-by-zip-search

PureTech Home Services provides radon testing and radon mitigation system installation services throughout south-central Wisconsin. Contact us today if you’re concerned about your exposure levels.

Photo by Richard Hurd

MMSD, Madison College and Exact Sciences Partnership Aims to Grow Opportunities for Early College STEM Academy Students

MADISON, Wis.—The Madison Metropolitan School District (MMSD), Madison College and Exact Sciences are joining forces to grow opportunities for students enrolled in the Early College STEM Academy, a program designed to prepare participants for success in college and careers in science, technology, engineering and mathematics-related fields.

Through a new partnership with Exact Sciences, students will gain firsthand insight into the world of biotechnology and the many career paths it offers. Throughout the school year, Early College STEM Academy students will connect with Exact Sciences professionals through three interactive experiences:

- Lab Tour (November): Students will tour Exact Sciences’ Cologuard laboratory to see how scientific innovation comes to life. They’ll learn about the roles involved in developing diagnostic tests and hear from team members about their journeys into science and innovation.

- Career Exploration (February): Students will dive into the science and strategy behind Exact Sciences’ newest product, ColorGuard Plus, as well as explore the wide variety of STEM-related careers at the company and take part in hands-on activities that demonstrate real-world applications of their learning.

- Celebration and Reflection (April): The year will conclude with a celebration recognizing students’ achievements and growth. Participants will reflect on what they’ve learned, explore their next steps in STEM and receive resume and interview tips from the Exact Sciences Talent Team.

“This partnership is about developing the next generation of innovators,” said Katie Boyce, senior director, corporate impact and strategic communications at Exact Sciences. “By showing students what science looks like in action and introducing them to real career paths, we hope to inspire them to see how their passion for STEM can shape their future.”

The Early College STEM Academy offers MMSD students the opportunity to earn college credit through Madison College while completing their high school studies. By combining classroom instruction with hands-on experiences like those offered through Exact Sciences, the Academy helps students develop the technical knowledge, professional skills and confidence needed to thrive in science and technology careers.

“The STEM Academy shows the power of collaboration,” said Cindy Green, MMSD assistant superintendent of strategy and innovation. “Our students thrive when schools, higher education and employers work together.”

STEM education offers students not only subject knowledge but the critical thinking, problem-solving, and innovation skills required in tomorrow’s workforce. In Wisconsin, demand for STEM and biotech talent is real: Per the University of Wisconsin–Madison, the city alone consistently has around 300 job openings in the biotechnology sector. Meanwhile, bioscience jobs in Wisconsin report average salaries around $107,000 annually, nearly double average U.S. income levels, according to UW Online Collaboratives.

Statewide projections also point toward growth in technical and STEM fields. Over the decade 2022–2032, Wisconsin is expected to add 225,071 new jobs across all sectors (a 7.1% growth rate), per the State of Wisconsin Department of Workforce Development. Within that broader labor market, STEM careers such as computer science, data science, and engineering are among the fastest growing nationally.

“Madison College is proud to stand alongside MMSD and Exact Sciences,” said Dr. Mark Thomas, Madison College executive vice president of policy and strategy. “Together, we’re building a stronger talent pipeline that will benefit our community and the state of Wisconsin.”

For students, experiences like lab tours, industry mentorship, and real-world project work help close the gap between classroom learning and employer expectations, providing a head start in high-demand, well-compensated fields.

Only students currently enrolled in the Early College STEM Academy are eligible to participate in this opportunity. For more information, please visit the MMSD website.

###

About the Madison Metropolitan School District

The Madison Metropolitan School District (MMSD) is the second-largest school district in Wisconsin, serving more than 25,000 students across 52 schools. The district’s vision is that every school will be a thriving school that prepares every student to graduate ready for college, career and community. With more than 6,000 teachers and staff, MMSD is committed to ensuring the district’s goals and core values are held at the center of its efforts, so students can learn, belong and thrive. For more information, visit mmsd.org.

Photo by Richard Hurd

Woodman’s Offering Advertising Space on Reusable Shopping Bags

The MARC Group has teamed up with Woodmans Market – Madison to launch a NEW Community Program!

Woodman’s Market – Madison will be handing out 2,500 large, reusable shopping bags to their customers for free!

One side of the bag will be promoting Woodman’s Market – and the rest of the bag will feature local businesses and professionals.

You will be the only business in your industry featured!

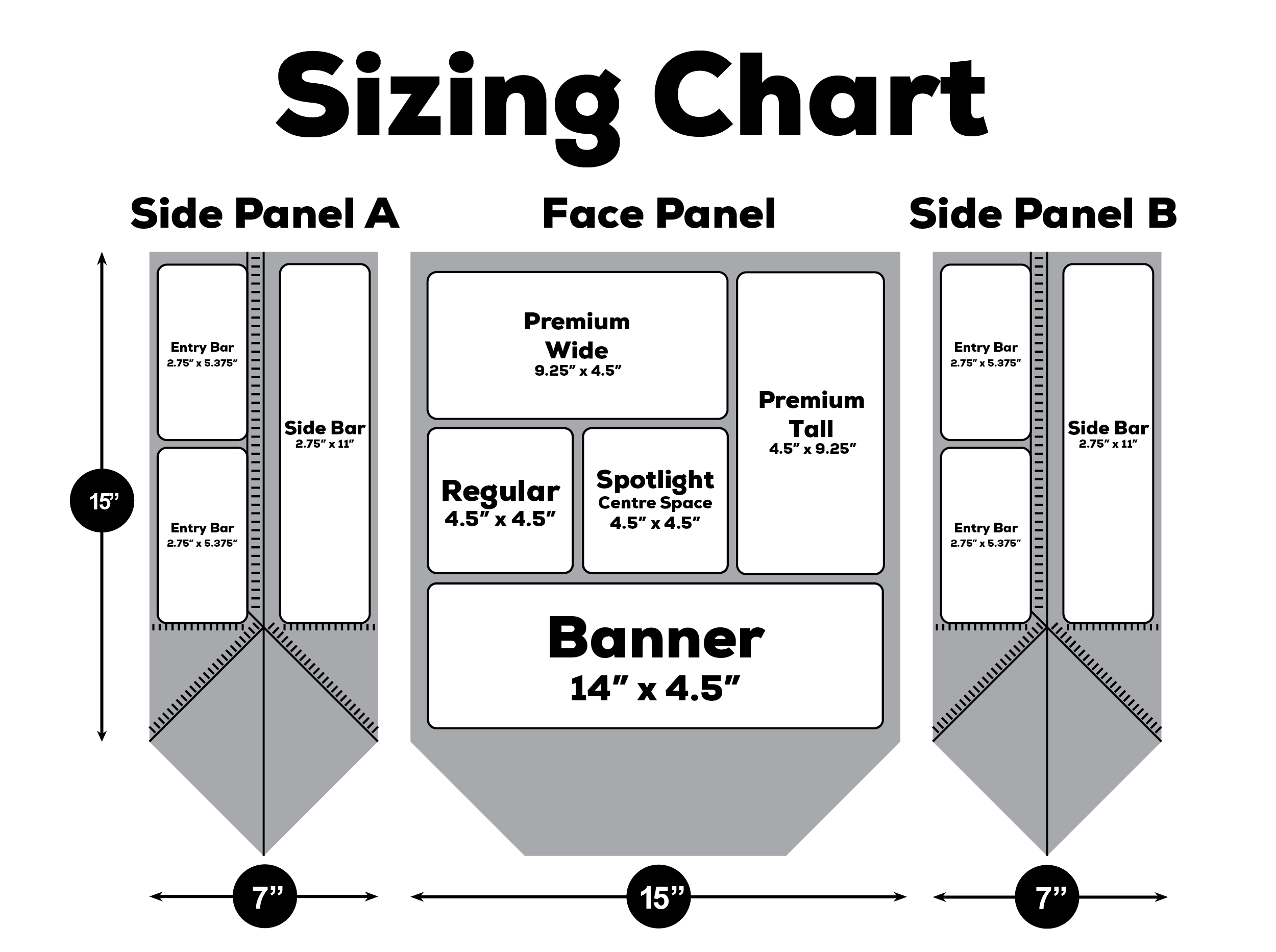

Face Panel

• Regular – $1,195 • Spotlight – $1,495

• Premium – $2,390 • Banner – $3,585

Side Panel A or B

• Entry Bar – $595 • Side Bar – $895

To learn more and purchase an ad, contact Pat Lupo, The MARC Group Senior Advertising Specialist

(262) 240-8616